What is ElderShield?

ElderShield is a severe disability insurance scheme that provides monthly cash payout of $300 or $400 up to a maximum period of 5 or 6 years.

CPF members with a Medisave account will be automatically enrolled into the scheme once they reach 40 years old unless they opt-out.

In order to make a claim under this scheme, a person must lose the ability to perform at least three out of the six daily activities: Washing, Dressing, Feeding, Toileting, Mobility, Transferring.

What is CareShield Life?

In May 2018, the Ministry of Health announced that it will be introducing a mandatory insurance scheme that will enhance the existing Eldershield by 2020 for those aged between 30 and 40.

These enhancements include:

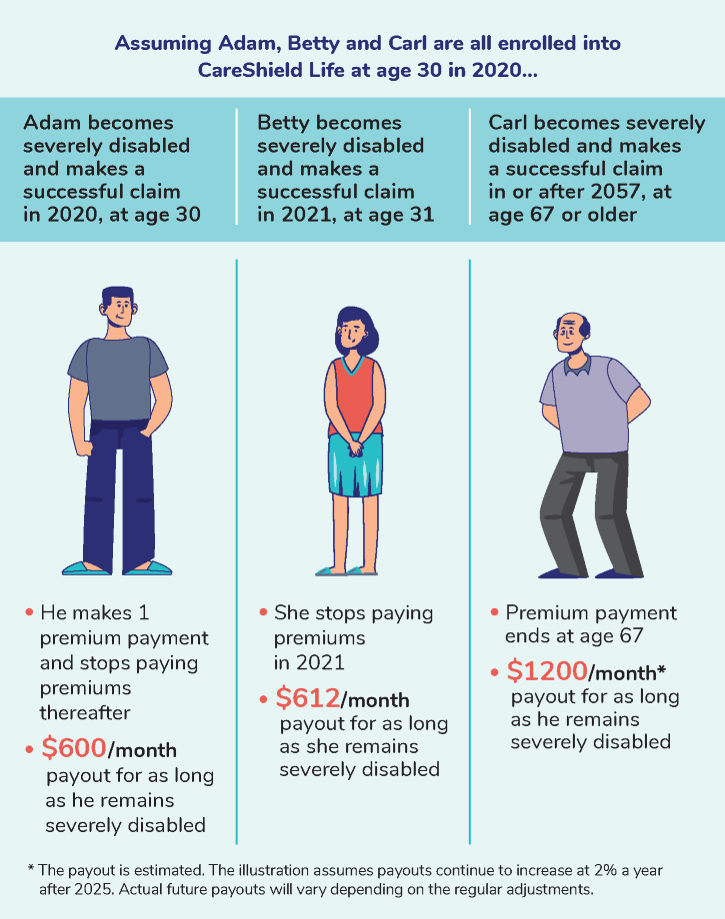

- Lifetime cash payouts, for as long as the insured remain severely disabled;

- Increasing payouts, starting at $600 per month in 2020 and increases annually until age 67, or when a successful claim is made, whichever is earlier;

- Government subsidies to make it affordable, with no one losing coverage if they cannot pay premiums;

- Premiums can be fully paid by MediSave.

Similar to Eldershield, to claim under Careshield Life, one has to lose the ability to perform at least three out of six daily living activities.

The infographic below shows 3 examples of how the claim process works.

Source: CareShieldlLife.gov.sg

Is CareShield Life coverage enough?

According to CareShield.gov.sg, 1 in 2 healthy Singaporeans aged 65 could become severely disabled in their lifetime, and may need long-term care.

Some causes of severe disability may include the following:

- Worsening of chronic diseases (e.g. diabetes)

- Illnesses as we age (e.g. dementia)

- Severe injuries sustained from accidents (e.g. spinal cord injuries).

The question you need to ask is “Will $600 per month from CareShield Life be enough to pay for the long-term care costs of a severed disabled person”?

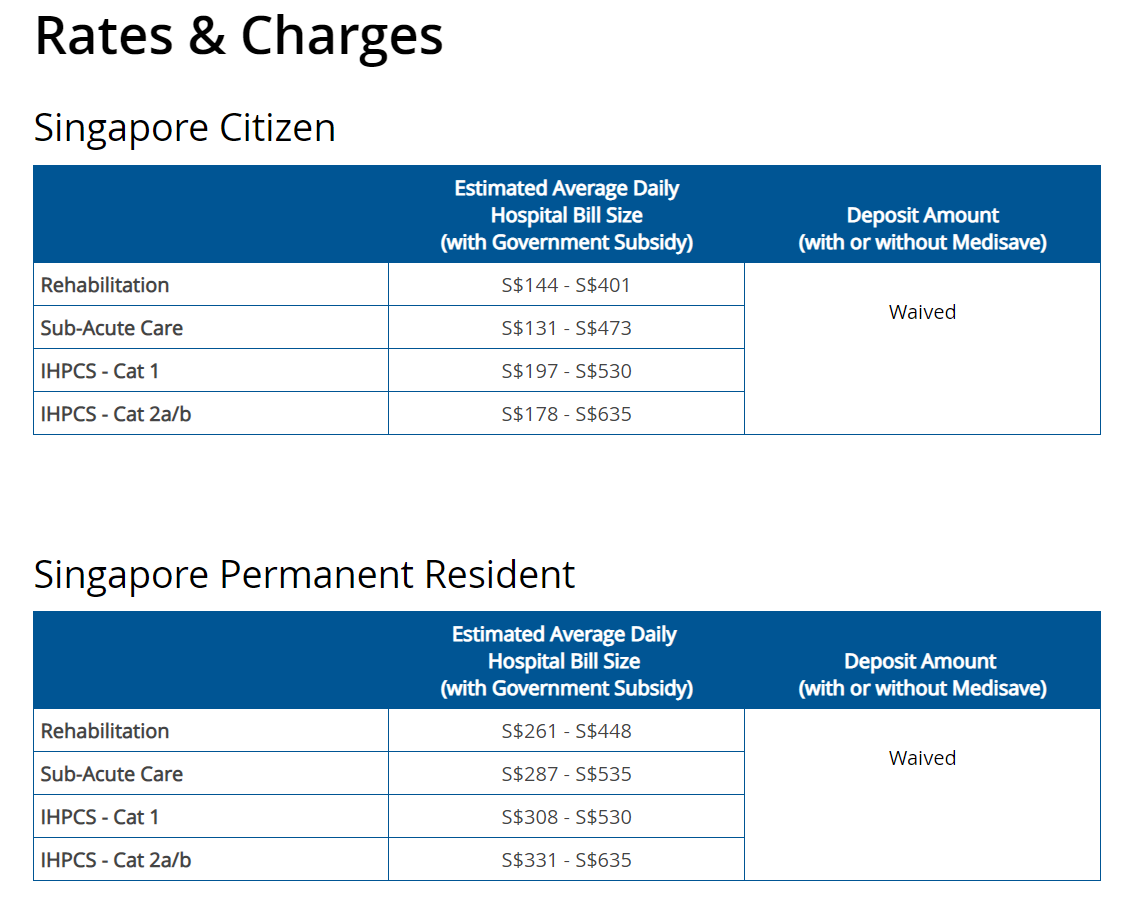

Let us look at the cost of rehabilitation for Sengkang Community Hospital.

Source: Singhealth.com.sg

As you can see, the estimated average daily hospital bill size (with Government Subsidy) for rehabilitation is between $144 to $401 per day.

Using the lowest range of $144 per day x 30 days = $4,320 per month. This amount is already 7.2 times that of the Careshield Life monthly payout.

Moreover, it may also be necessary to hire a helper or maid to care for the disabled person once he or she is discharged.

The table below shows the estimated monthly salary of a maid in Singapore according to MSIG.

Source: MSIG.com.sg

The Monthly Salary of Maid in Singapore (Minimum wage) is between $450 to $570. This estimation does not include the living expenses (eg. food, utility, transport) of the maid, and extra salary for working on rest days, which could reasonably cost another $250/month. $570 + $250 = $820 per month.

From the above information, one can see why the $600 per month payment from CareShield Life may not be sufficient.

So how do you fix the problem?

A good solution is to purchase a CareShield Life supplement plan from a Private insurer to enhance your monthly payout.

The CPF Board allows Singaporeans & PRs to utilize up to $600 from Medisave Account to pay for CareShield Life supplements, so you may not need to fork out cash.

If you’d like to learn more about enhancing your CareShield Life coverage, book an appointment with our Financial Planners today!