It’s 2019 and a brand new year!

Some of us looking to change jobs after getting our year end bonus.

Others might be entering Singapore’s workforce for the very first time.

If you belong to the latter, there are 4 important facts that you must know about CPF when you start your first job.

1. 3 Main Types of CPF Account

These are 3 main types of CPF account:

- Ordinary Account (OA) used mainly for housing

- Special Account (SA) used mainly for retirement income

- Medisave (MA) used mainly for healthcare expenses

For those age 35 and below, every month, you (the employee) are required to contribute 20% of your salary to your CPF account while your employer must contribute another 17% of your salary to your CPF.

2. CPF Interest Rate is 1% Higher for First $60,000 in your CPF Account

The base interest 2.5% for CPF-OA and 4% CPF-SA.

On top of that, the first $60,000 in your CPF account (with up to $20,000 from the OA) also earns an additional 1% interest.

This means you can earn as much as 3.5% from CPF-OA and 5% from your CPF-SA.

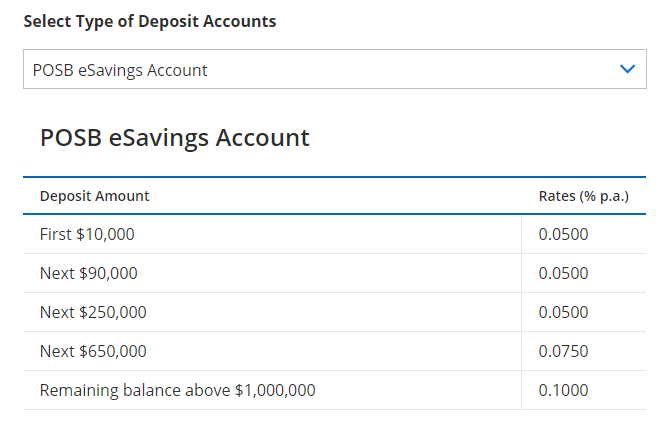

This is higher than the 0.05% per annum interest rate offered by the POSB eSavings Account (as of 02 Jan 2019).

Source: https://www.posb.com.sg

Considering that there isn’t any transactional cost or investment risk when you deposit money into CPF, it is a good deal for those who have low risk tolerance.

The main downside is it will be difficult for you to withdraw your money from CPF until you reach your retirement age.

3. You can pay less Tax if you Top Up your CPF Special Account (CPF-SA)

If this is your first working year and earn a high income, you will be receiving a letter from IRAS next year asking you to file income tax.

You can reduce the amount of tax you need to pay by making a voluntary CPF cash top up.

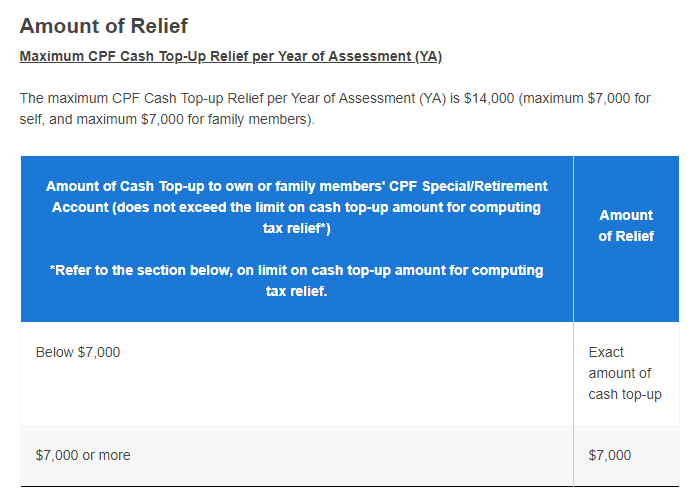

The maximum CPF Cash Top-up Relief per Year of Assessment is $14,000 (maximum $7,000 for self, and maximum $7,000 for family members). By you topping up your CPFSA, you can pay less tax, while building up your retirement funds at the same time.

Source: https://www.iras.gov.sg

4. You can use your CPF to buy an Integrated Shield Plan

You can use your Medisave to buy an integrated shield plan.

Considering the high healthcare cost in Singapore, just one hospital bill could potentially wipe out a significant, if not entire amount of your hard earned savings.

You may download the excel spreadsheet from the MOH website which contains full list of historical transacted bill information: https://www.moh.gov.sg

Looking at the costs, it would make a lot of financial sense to allocate a small amount of your Medisave to buy an integrated shield plan from one of the private insurers that would cover the cost of treatment.

If you like this article, please share with your family and friends who may find it useful.