Time flies. By the time you are reading this article, it’s probably beginning of February 2019.

You’re already well into this new year, but take time to consider your investment options.

If you begin saving now, you’ll may have enough to buy a new car or pay a short holiday trip at the end of this year.

However, it’s better to think long-term and start planning for retirement.

This means investing part of your money and let the power of compounding work for you.

Define Your Financial Goals

You won’t reach your financial goals unless you are clear on what they are.

Are you planning for a short term objective like saving money for your house’s down payment, or a long term objective like preparing for retirement?

Once you know your goal, you can calculate how much money you actually need.

Know Your Time Horizon

Different investment options are suitable for different time horizons.

If your time horizon is short, it is recommended that you choose less volatile and more liquid investments.

However, if your time horizon is long, you can worry less about short-term fluctuations and focus on investment that can produce long term gains.

The Best Time to Invest

Financial markets will always fluctuate. While some investors believe in timing the market, it may not always be the best thing to do because even experts can get it wrong.

Time is money in the investment world. You want to put your money to work and add to it regularly, and reinvest your investment returns if possible.

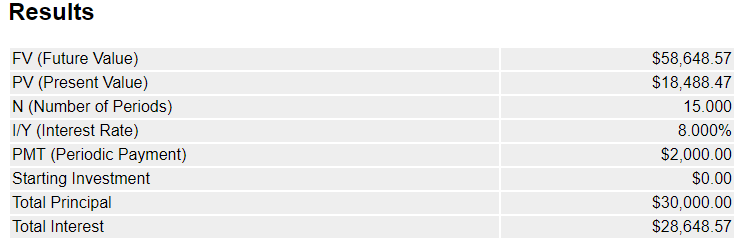

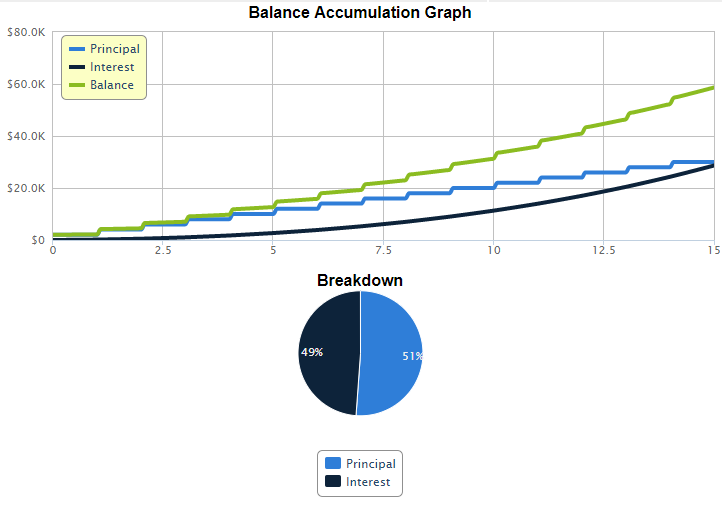

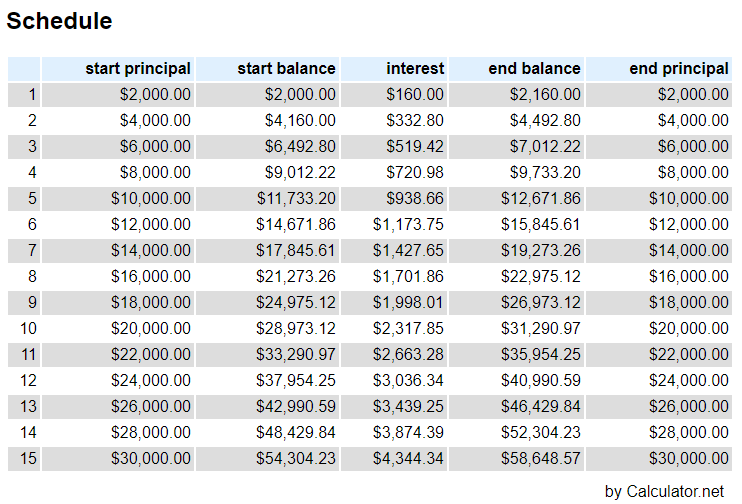

A $2,000 investment each year, which compounds at 8% annual rate, is worth about $58,648.57 (almost double your principal) after 15 years. See the calculation results below.

Generated using calculator.net

So when is the best time to invest? I’d say now is the best time.