If you own a HDB flat, you can consider the Lease Buyback Scheme (LBS) as part of your retirement plan.

What is the Lease Buyback Scheme?

Lease Buyback Scheme is a government scheme which gives elderly Singaporean households the option to monetise their flats to receive a stream of income in their retirement years, while continuing to live in it.

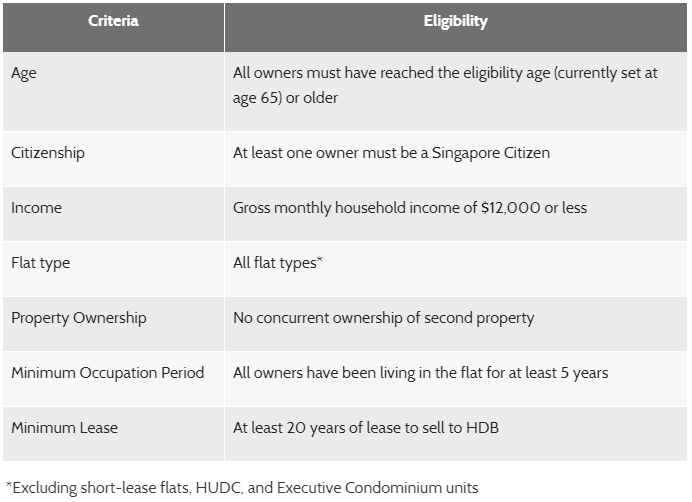

Eligibility Conditions of the Lease Buyback Scheme

In order for your household to qualify for the LBS, the following conditions must be met:

Source: hdb.gov.sg

How does the Lease Buyback Scheme work?

1. Through the Lease Buyback Scheme, you can sell part of your flat’s lease to HDB and receive up to $20,000 or $10,000, or $5,000 of LBS bonus, respectively.

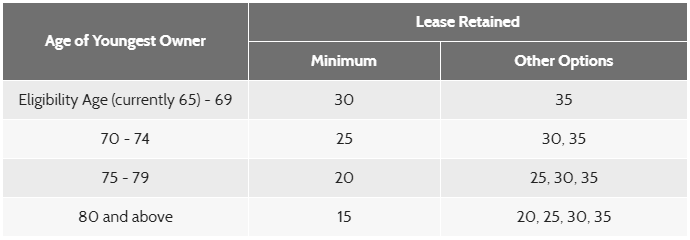

2. Your household will have the flexibility to choose the length of lease to be retained, based on the age of the youngest owner. The duration of the lease retained determines the amount of net proceeds unlocked.

Source: hdb.gov.sg

3. The net proceeds from selling part of your flat’s lease will be used to top up your CPF Retirement Account (RA), to the specified requirements which depends on whether your flat is under single or joint ownership:

Source: hdb.gov.sg

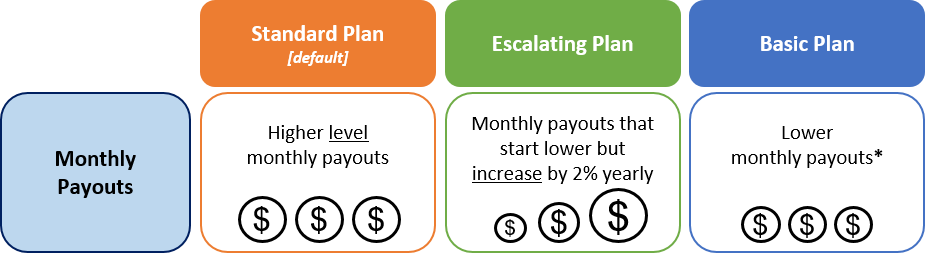

4. Six months before you reach your CPF LIFE payout eligibility age, you can use your CPF RA savings to participate in one of the three CPF LIFE plans and receive monthly payouts:

Source: cpf.gov.sg

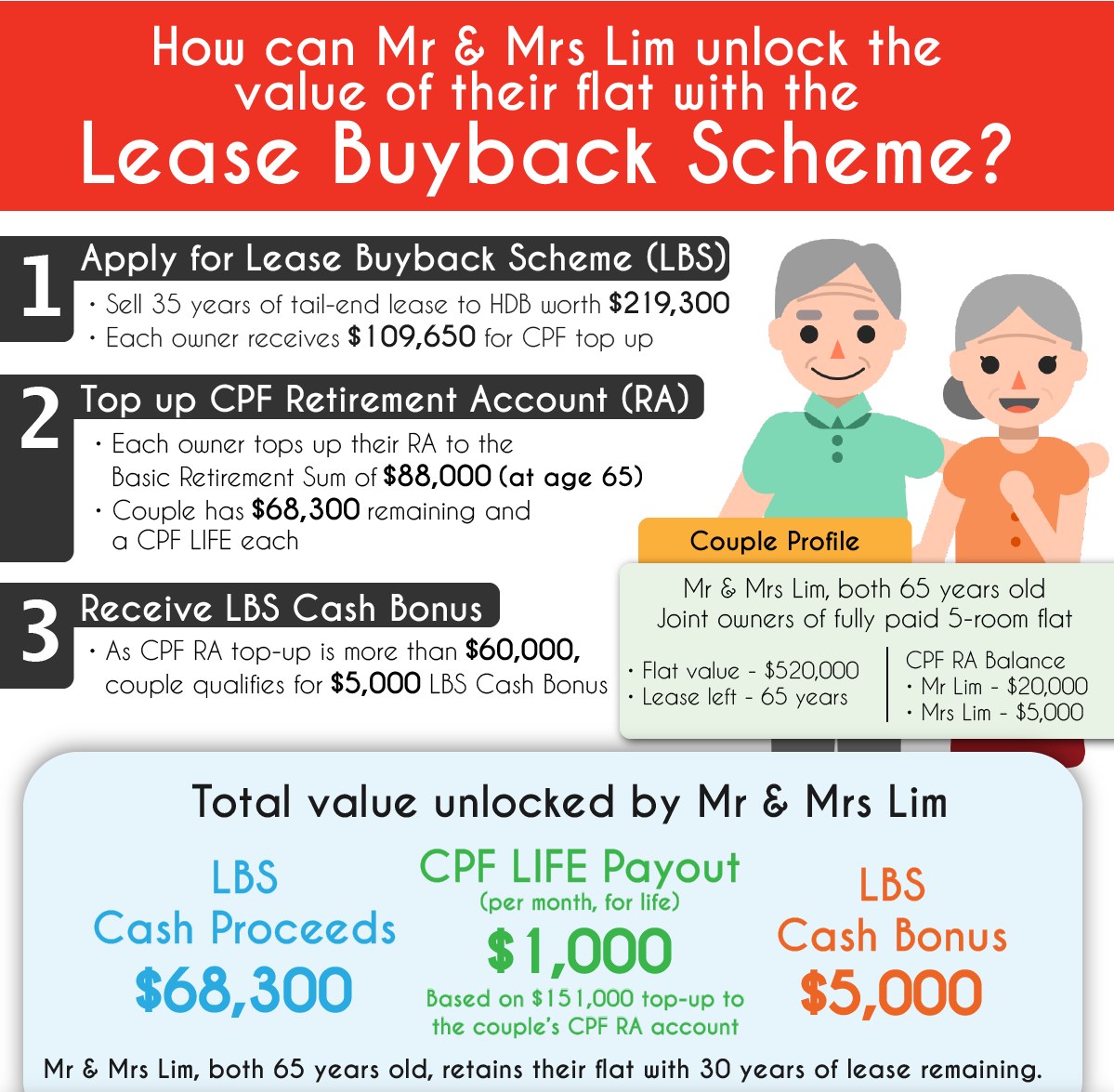

Example of Lease Buyback Scheme

A couple, both 65 years old, are joint owners of a fully paid 5-room flat worth $520,000, with 65-year remaining lease. They choose to keep a 30-year lease, and sell the tail-end 35-year lease to HDB.

Source: hdb.gov.sg

Earning Rental Income

During the lease, you can continue to rent out your bedrooms to earn rental income. However, you are not allowed to rent out the whole HDB flat.

Are there any alternatives for Lease Buyback Scheme?

Yes, there is the Silver Housing Bonus (SHB) Scheme. If you own a bigger flat type, you can choose to right-size your flat and supplement your retirement income through the Silver Housing Bonus scheme.

The SHB and LBS are both monetisation options to help elderly Singaporeans enhance their retirement income. They cater to different preferences and needs. The SHB caters to those who wish to right-size to a smaller flat, while the LBS caters to those who wish to remain in their current flat.

Conclusion

Lease Buyback Scheme is one of the way we can utilize our HDB flats to provide part of the funding for our retirement needs.

If you need help integrating the LBS into your retirement plans, please contact your trusted FLA Organization Financial Planner today.