2018 seems like a good year for giving birth.

Many proud parents are posting cute photos of their newborn babies on Facebook and Instagram and getting a ton of “LIKES” for it.

Nothing quite compares to the joy of seeing your baby born healthy. However, with a new family member there are new responsibilities.

This includes making sure they have adequate insurance coverage. There are 4 types of insurances you should consider for your child:

- Health insurance

- Personal accident insurance

- Life insurance

- Savings plan

Health Insurance

Health insurance should be the first type of insurance you should consider for your newborn child because it covers hospitalization expenses. Hospitalization is quite common for newborns. Common reasons for children to be hospitalized may include:

- Fever

- Skin rashes

- Respiratory disorders

- Accidents

If your baby is Singaporean, he or she is automatically covered by MediShield Life upon birth.

However, MediShield Life coverage is sized for treatment in public hospitals that are subsidised by the Government. It is meant for people to stay in B2 ward and below. For those who choose to stay in private hospitals or in A or B1 ward types at public hospitals, the MediShield Life payout will only make up a small proportion of the bill. The patient may therefore need to pay more of their bill using MediSave and/or cash.

If you want your child’s health insurance to have a higher coverage to pay for private hospital stay and treatment, then we recommend you get an Integrated Shield Plan for him or her.

These are the Integrated Shield plans (IPs) available on the market.

Personal Accident Insurance

Another type of insurance you should consider for your child is personal accident insurance. The reason why you might need this on top of health insurance is because your child might get into minor accidents (eg. falls, cuts, bruises, etc) which don’t require hospital treatment.

In this case, you won’t be able to claim from health insurance since your child isn’t hospitalized. This is where personal accident insurance can help fill in the gaps.

Life Insurance

You should also consider buying life insurance for your child. There are 2 types of Life Insurance.

- Whole Life

- Term Life

Most Whole Life insurance covers death, total permanent disability, and critical illnesses and also include savings component that enable the policy to accumulate cash value. There are many advantages of buying whole life insurance for your child at a young age:

- Lower premiums when policy is bought at a young age

- Easy acceptance by insurer when insured is in good health

- Longer time for policy to accumulate cash value. For example if you buy a life insurance policy for your child at a few months old, by the time your child is 25 years old, the cash value of the policy might already surpass than the total premium you’ve paid for that policy.

- There are also limit premium payment whole life plans which you only need to pay for a limited number of years but the coverage last for whole life and the cash value continues to grow without the burden of continuing lifetime payment of premium.

Term Life insurance is similar to Whole Life insurance, but usually offers higher coverage for the same premium paid. However, Term Life policies don’t have any cash value. It’s similar to car insurance where you don’t get any returns if no claim is made. It is a good alternative for parents who have a smaller budget and still want reasonable coverage for their children.

Education Funding Plan

Another type of insurance worth considering for your child is an Education Funding plan. This can be a traditional endowment policy that pays out a lump sum after a specified period, or an investment linked plan which you can cash in any time when you need money to fund your child’s education.

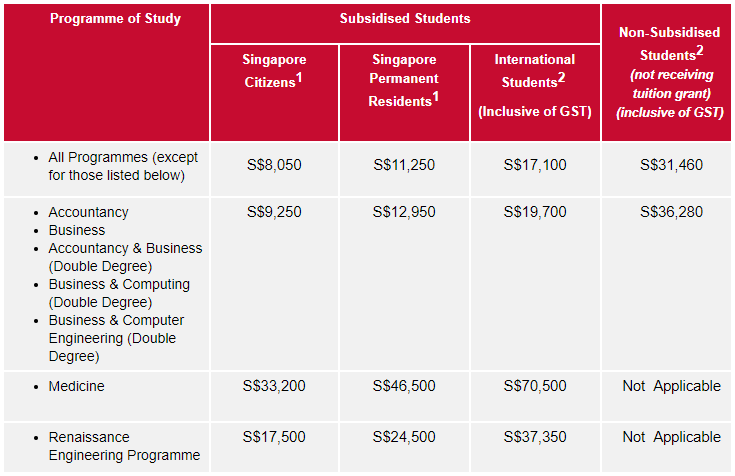

For Singapore Citizens, annual fees for a degree programme can cost anywhere from S$8,050 to S$70,500. Multiple it by the number of years of the programme (assuming each programme takes 3 years to complete); it will cost about S$24,150 to S$211,500 to complete a degree programme. If you wish to send your child for overseas studies, it will cost even more.

You need to have these financial numbers in mind, and also cater for inflation when you do education planning for your child.

Should you implement all 4 types of insurance for your child at once?

That depends on your finances. We believe that good financial planning means working within your budget. Please consult with your Financial Planner, or contact us for more information today.