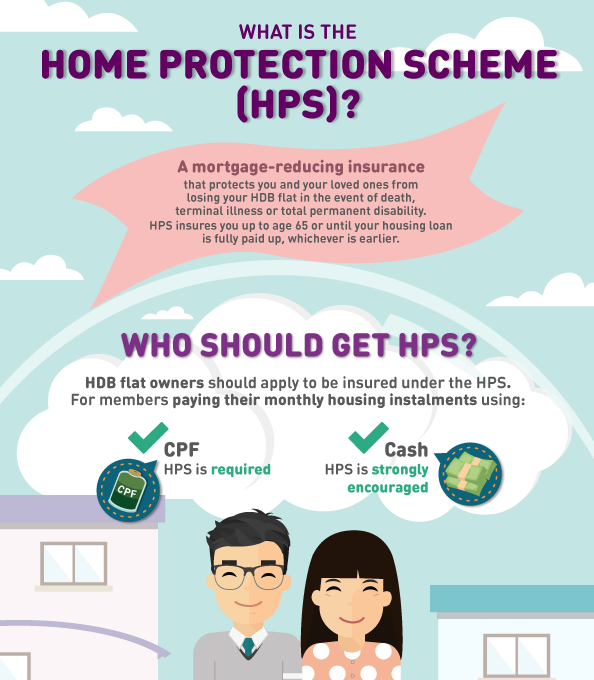

Home Protection Scheme (HPS) a mortgage-reducing term insurance that protects you and your loved ones from losing your HDB flat in the event of death, terminal illness, or total permanent disability.

Members who are paying monthly housing instalments on their HDB flat using CPF savings or cash, can apply for the Home Protection Scheme.

In the event of claim, the sum insured will be used to payoff or reduce the outstanding loan (if the sum insured is less than the loan balance at death). Any amount in excess of the housing loan would be paid to the insured nominees.

Benefits of Home Protection Scheme

- In the event of claim, the HPS would settle the outstanding loan up to the sum that the member was insured for. The other joint owner would need to continue paying off the remaining portion of the loan not covered by the deceased member’s Home Protection Scheme cover. For instance, in the event of death, if the deceased member had only obtained 20% Home Protection Scheme cover, his joint owner will need to continue paying the 80% balance of the loan.

- HPS has one of the most affordable premiums on the market.

- Premium can be paid using savings from the CPF Ordinary Account

Before joining the scheme, you should know how much coverage to apply for.

Your share of the HPS cover should at least match the proportion of the monthly housing instalment which is payable with your CPF savings and/or cash. The total share of cover per household should add up to at least 100%.

Also, you and your co-owner(s) can each choose to insure for a higher share of cover, for up to 100% per owner. In the event of a claim, HPS will settle the outstanding housing loan up to the insured sum, based on the share of cover applied.

You may use the HPS Premium Calculator to estimate your HPS premium, based on your decided share of cover.

Members can use the savings in their Ordinary Account to pay the annual premium for the coverage.

But if they do not have enough savings in their Ordinary Account for the premium, they can apply to pay the outstanding premium in cash or through their spouse’s CPF savings, if he or she is also insured under the scheme. The spouse needs to authorize the CPF Board to deduct his or her CPF to pay for the member’s premium.

Limitations of HPS

- Acceptance of the application would be subject to the requirement of good health. You may be required to undergo a medical examination, and produce a copy of the medical report from your attending doctor.

- Only covers up to age 65 or the end of the loan period, whichever is earlier. Should your housing loan only be paid up after you turn 65, do consider getting private insurance coverage after your HPS cover ends at 65.

If your private insurance coverage is enough to cover your outstanding housing loan against death, terminal illness (TI) and total permanent disability (TPD) until the end of your loan term or age 65, whichever is earlier, you may apply to be exempted from the Home Protection Scheme (HPS)

If you need advice on private insurance coverage, book an appointment with our Financial Planners from FLA Organization for more information today.