Every parent want to help their children succeed in life.

This is why many parents are willing to spend big bucks to send their children to top schools and universities, so that they have an competitive edge over their peers after they graduate.

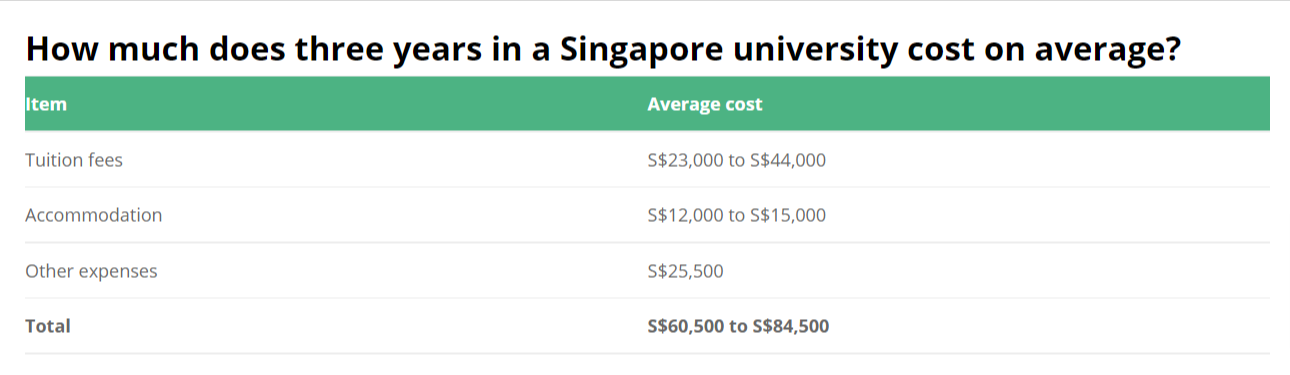

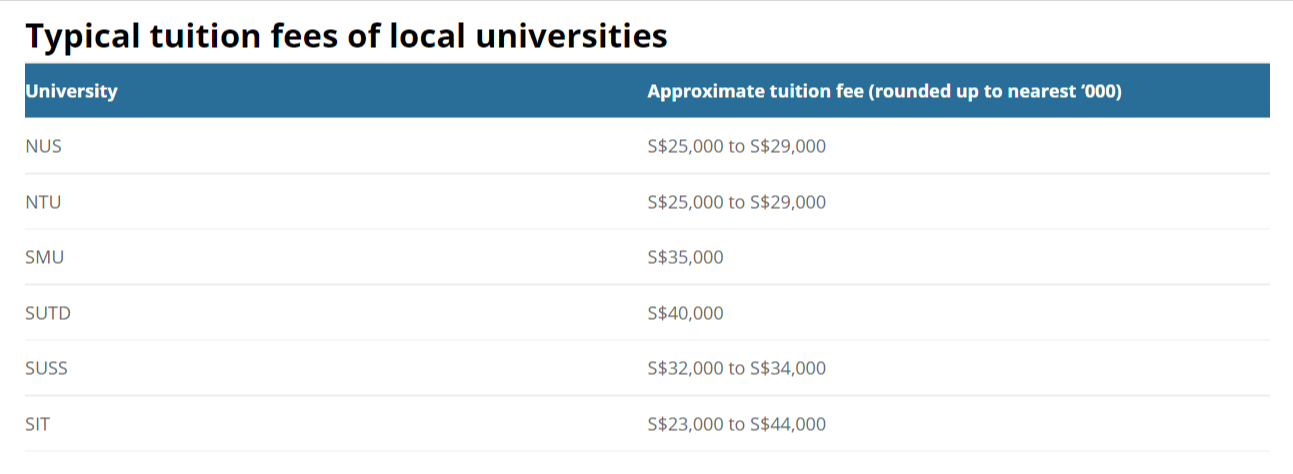

However, Tertiary education in Singapore can be very costly. According to an article published by SingSave.com.sg, a typical three-year university course in Singapore can cost between S$60,000 to S$85,000 in total. This excludes more expensive courses such as medicine, and includes government subsidies.

Source: SingSaver.com.sg

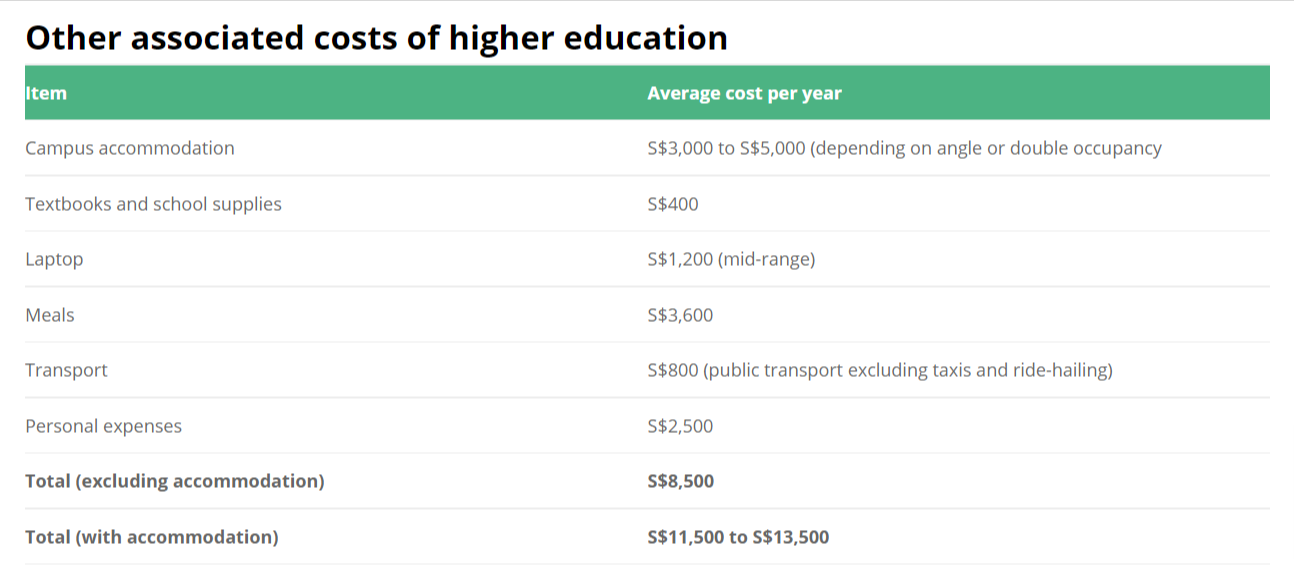

The figures above takes into account on-campus accommodation, which, apart from tuition fees, makes up a major part of the costs of higher education in Singapore. Those who are able to live at home while studying can ignore this cost.

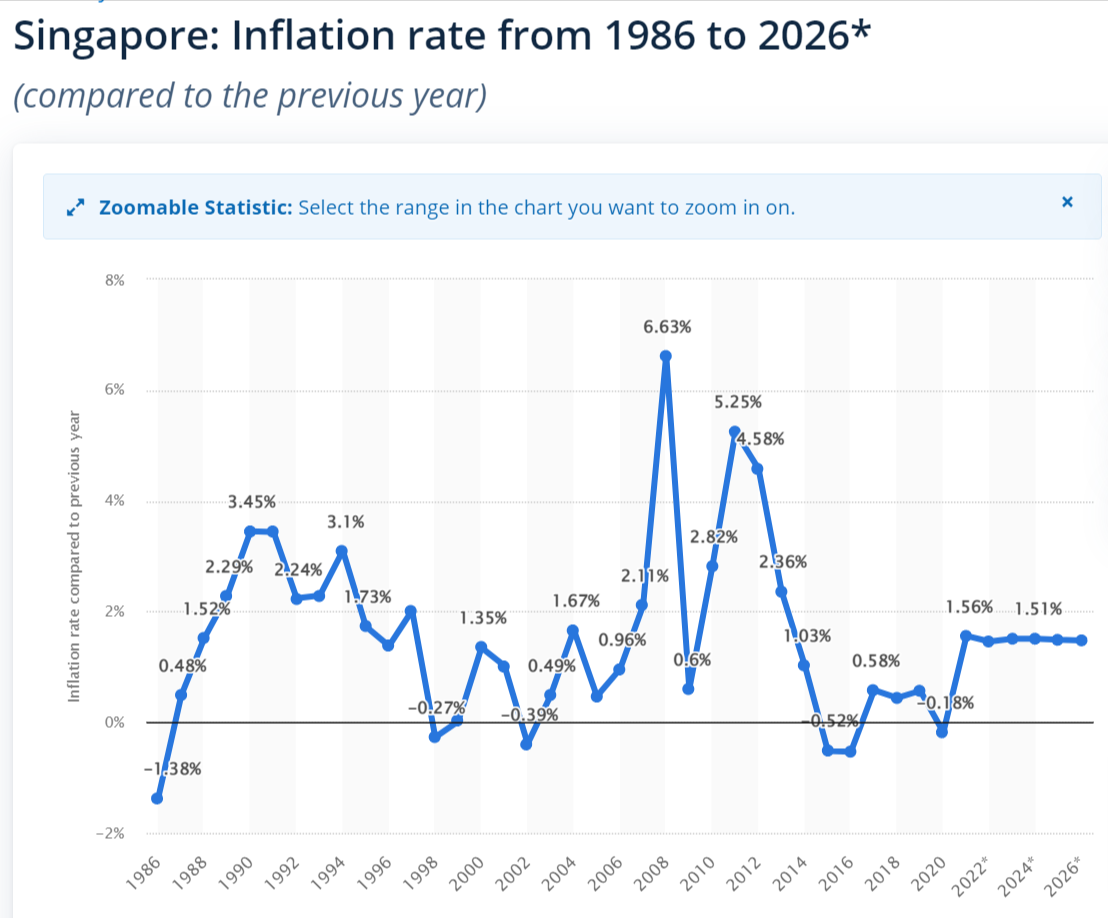

On top of that, inflation will also likely result in the costs of Education to be much higher 10-20 years from now.

Source: Statista.com

To ensure enough funds to pay for tertiary education, parents should plan their finances years ahead before their children attend their ideal polytechnic or universities.

Start by calculating the estimated amount needed, and how many years you have to reach that target. The target savings should include the education cost inflation, or the possible increase in fees over the 18-20 years.

For example, a Singapore-based student typically enters university at around 18 years old (or 20 years old for men).

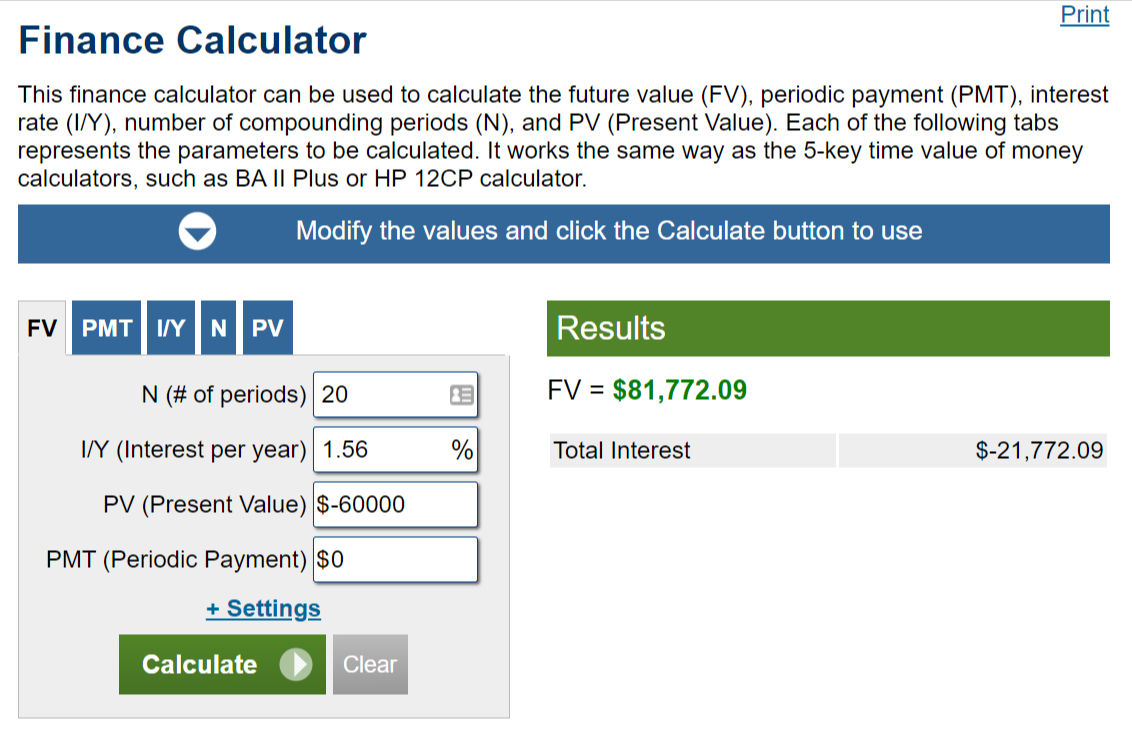

Based on the average cost of $60,000 for a Singapore undergraduate education, with an assumed annual inflation rate of 1.56%, the amount needed in 20 years’ time would be around S$82,000.

From this, parents can work backwards to determine the amount to regularly set aside. It is recommended to start early to enjoy the benefits of compounding interest on your savings over time.

There is a wide variety of financial products which may help you achieve your children education savings goal. These include investment products for those who want a higher potential return, or endowment products for parents who are more conservative.

If you want professional advice on education planning for your children, you may book an appointment with our financial advisors. Simply fill in this form, and we will get back to you within a day or two. No obligations are required.