If you live in Singapore, you may remember seeing these advertisements about MediShield Life a few years ago.

However, unless you work in the CPF Board, or work as an insurance agent or underwriter, may not remember the details about MediShield Life.

What is MediShield Life?

The following information are excerpts from the MOH.gov.sg:

What is MediShield Life?

MediShield Life is a basic health insurance plan that protects all Singapore Citizens and Permanent Residents against large hospital bills for life, regardless of age or health condition.

What are the benefits?

MediShield Life is sized for subsidised treatment in public hospitals and pegged at B2/C-type wards.

If you choose to stay in an A/B1-type ward or in a private hospital, you are still covered by MediShield Life. However, you will find that your MediShield Life payout will cover only a small proportion of your bill. You would need to draw from MediSave and/or cash to pay the balance.

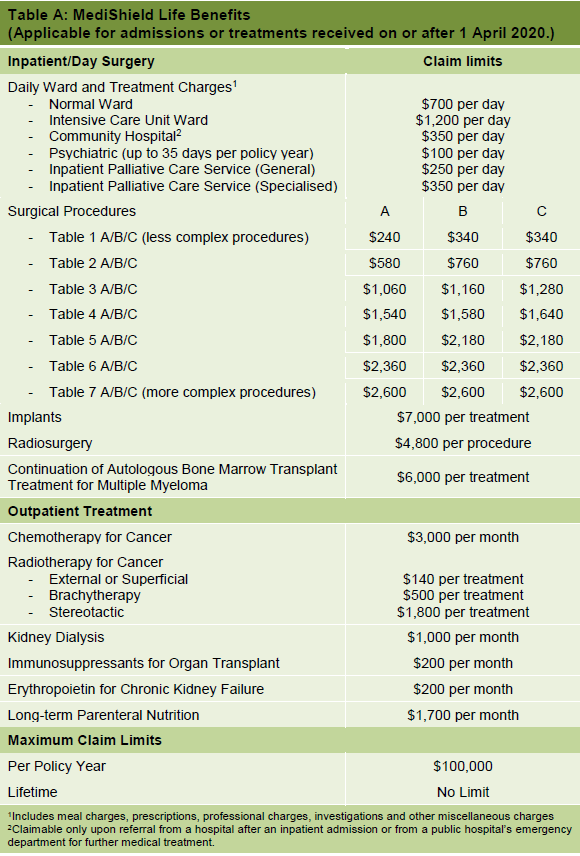

MediShield Life Benefits

Source: moh.gov.sg

How can I enhance MediShield Life coverage?

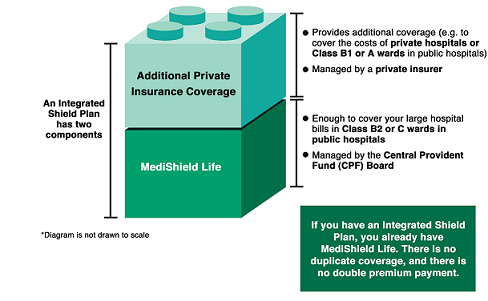

If you plan to use an A/B1-type ward in a public hospital or go to a private hospital for your future hospitalisations, you can consider purchasing a MediSave-approved private Integrated Shield Plan (IP), an insurance plan that comprises:

- MediShield Life

- Private insurance coverage providing additional benefits and coverage

Source: moh.gov.sg

Key Takeaways

- Medishield Life covers large Hospital bills.

- It is meant for public hospitals and is pegged at B2/C-type wards. If you choose to stay in an A/B1-type ward or in a private hospital, the amount claimable will be reduced.

- There is a maximum claim limit of $100,000 per policy year.

Why would you want to get Private Insurance (Integrated Shield Plans) to supplement MediShield Life?

- You prefer receiving treatment in A/B1 wards, or private hospitals.

- You want higher claim limits for Inpatient/Day Surgery, and Outpatient Treatment.

- You want higher claim limits than $100,000 per policy year.

- You want to cover MediShield Life co-insurance and deductibles too.

We will explain what MediShield Life co-insurance and deductible are in part 2 of this article.

If you need to engage a professional financial planner, contact your trusted FLA Organization financial planner today!