In part 1, we talked about MediShield Life and what it covers. Today we shall cover how the MediShield Life claim works.

How do MediShield Life Claims work?

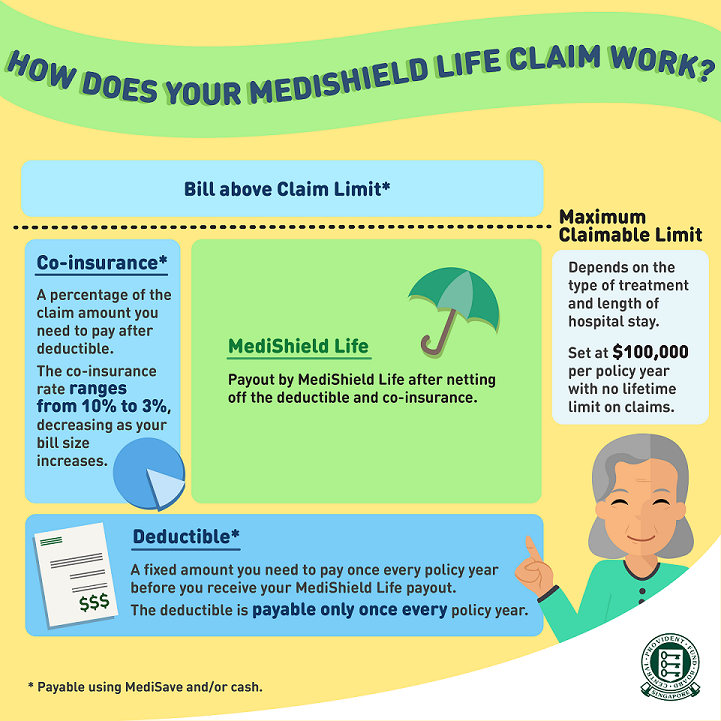

Let’s take a look at this infographic from the CPF website.

There are 3 key components being mentioned:

- Deductible

- Co-insurance

- Claim Limits

What is the deductible?

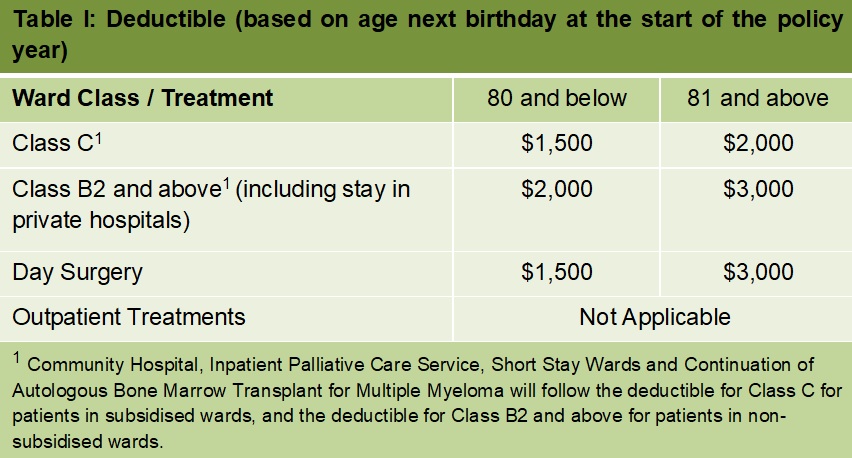

Deductible is the fixed amount that the insured needs to pay first in a policy year before any payout from MediShield Life. The deductible paid can be accumulated if there is more than 1 claim in the policy year. The deductible ranges from $1,500 to $3,000 of the claimable amount depending on age and ward class as shown in the table below.

What is the co-insurance?

Thereafter, you will need to co-pay a portion of the claimable amount, known as the co-insurance. Co-insurance is three-tiered, ranging from 3% to 10% as the bill size increases.

What is the claim limit?

There is also a maximum claim limit of $100,000 per policy year with no lifetime limit on claims.

In summary, you can only claim a payout from MediShield Life, after netting off the deductible and co-insurance. The payout is also subject to a maximum claimable limit of $100,000 per policy year.

Do you think the MediShield Life coverage and MediSave is sufficient for you?

Source: Straits Times

In the past, there has been a case in which a man’s 40 years of MediSave was wiped out by in 3 months, due to expensive medical costs incurred by Cancer Treatment for his daughter. This cautionary tale tells us why we should never take good health for granted.

There are many Singaporeans and PRs who choose to purchase Integrated Shield (IP) plans to supplement their MediShield Life. They typically do it for one or more of these reasons below:

- They prefer private hospitals over government hospitals.

- They don’t want to worry about deductibles and co-insurance.

- They think the coverage of $100,000 per policy year is insufficient.

- They are able to afford the premiums of the IP, which can funded using MediSave and/or cash.

If you’d like to learn more about Integrated Shield plans, contact your trusted FLA Organization financial planner today!