What is CareShield Life?

If you live in Singapore, you probably heard of the ElderShield… but what about CareShield Life?

ElderShield which is a basic long-term care insurance, is the predecessor of CareShield Life. It was first introduced in 2002 and targeted at severe disability, especially during old age.

When ElderShield was introduced, it provided payouts of $300/month for up to 5 years upon severe disability. In 2007, it was reviewed to provide better benefits of $400/month for up to 6 years.

In 2020, ElderShield was replaced by CareShield Life, which had enhanced benefits. CareShield Life is a long-term care insurance which provides financial protection against long-term care costs of Singaporeans in the event of severe disability.

Born in 1979 or earlier

Your participation in CareShield Life is optional, and you can choose to join CareShield Life from end-2021, regardless of your age, as long as you do not have pre-existing disability. If you are born in between 1970 and 1979 (both inclusive), insured under ElderShield 400, and are not severely disabled, you will automatically be enrolled in CareShield Life in end-2021.

Born in 1980 or later

You will automatically be covered by CareShield Life on 1st Oct 2020 or when you turn 30, whichever is later, regardless of pre-existing medical conditions and disability.

What does CareShield Life cover?

CareShield Life will provide you with better protection and assurance for basic long-term care needs with:

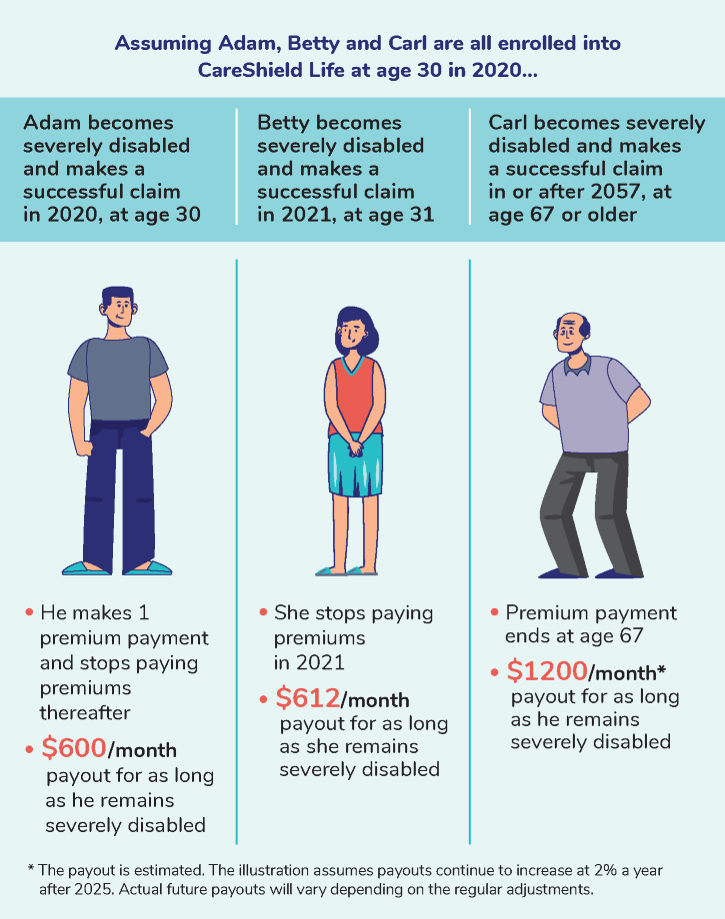

1. Lifetime cash payouts, for as long as the insured remain severely disabled;

2. Increasing payouts, starting at $600/month in 2020 and increases annually until age 67 or when a successful claim is made, which is earlier;

3. Government subsidies to make it affordable, with no one losing coverage if they cannot pay premiums;

4. Premiums can be fully paid by MediSave.

The infographic below shows 3 examples of how the claim works.

Source: CareShieldlLife.gov.sg

Why is CareShield Life important?

According to CareShield.gov.sg, 1 in 2 healthy Singaporeans aged 65 could become severely disabled in their lifetime, and may need long-term care.

Some causes of severe disability may include the following:

– Worsening of chronic diseases (e.g. diabetes)

– Illnesses as we age (e.g. dementia)

– Severe injuries substained from accidents (e.g. spinal cord injuries).

Is CareShield Life coverage enough for you?

The question you need to ask yourself is “Is $600 enough?”. With rising inflation of goods and services, and increasing cost of healthcare in Singapore, your answer is probably “No”. We shall discuss how we may tackle this problem in part 2 of our article.

If you’d like to learn more about CareShield Life, contact your trusted FLA Organization financial planner today!