What is the Dependants’ Protection Scheme and does it provide enough coverage?

Dependants’ Protection Scheme (DPS) is a term life insurance scheme that provides basic financial protection for you and your family in the event of death, terminal illness, or total permanent disability.

It is automatically extended to you upon your first CPF working contribution if you’re a Singapore Citizen or Permanent Resident between age 21 and 65.

The purpose of DPS is to provide CPF members and their families with cash benefits to tide them over the first few years should the insured member become physically/mentally incapacitated or pass away.

The claim would be paid to the insured member if he becomes physically/mentally incapacitated or to his CPF nominees upon death.

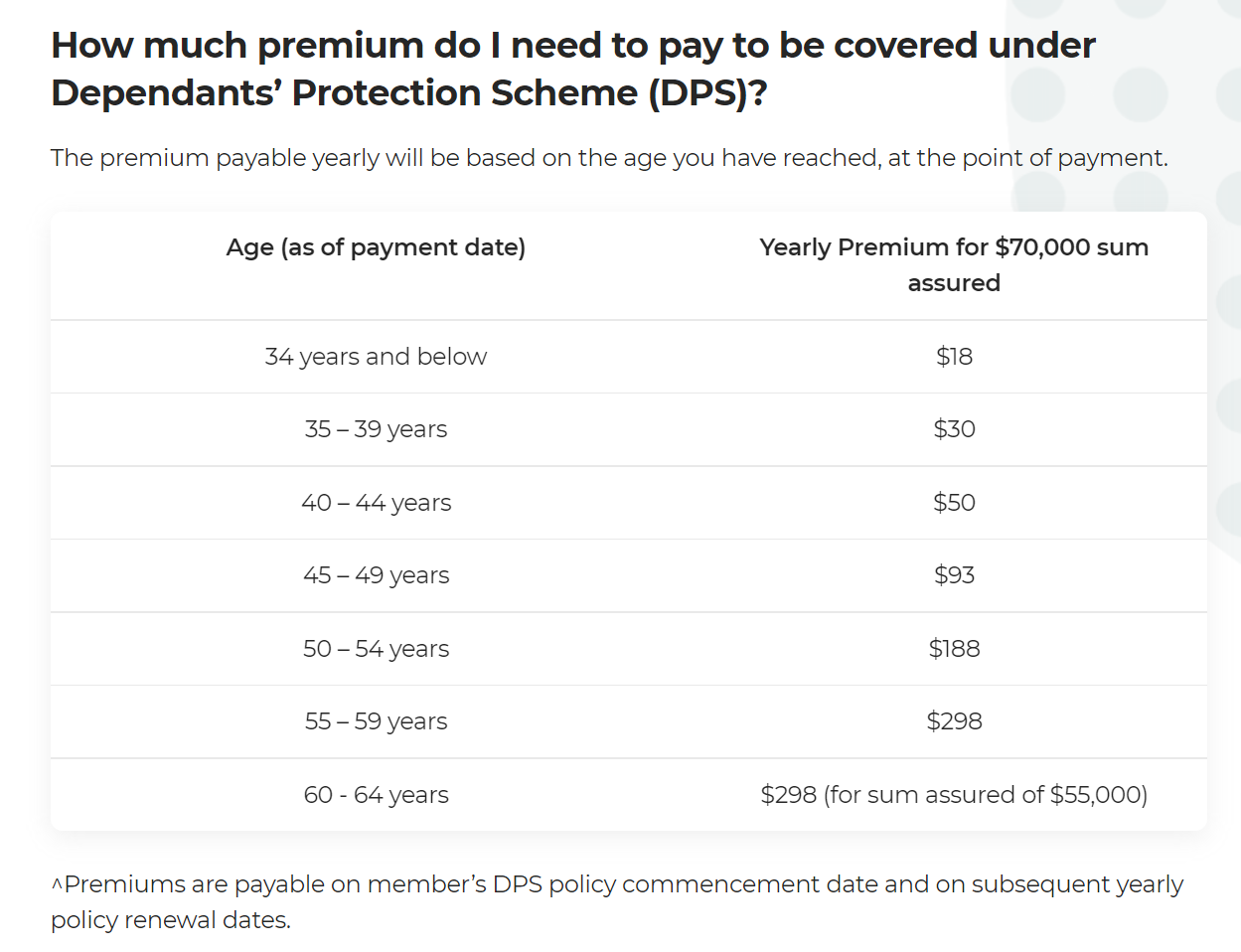

For a premium of $18 to $298 per year, DPS covers you for $55,000 to 70,000 sum assured.

Source: CPF

DPS is not compulsory and you may choose to terminate your coverage any time.

The Pros and Cons of DPS

Pros – The DPS is as affordable as $18/year and provides you a basic coverage of up to $70,000 for death, terminal illness, or total permanent disability.

Cons – The DPS maximum coverage is $70,000. When you’re young with little financial commitments, this amount may be sufficient. However, as people get married and start a new family, or their parents retire (and depend on them financially), more insurance coverage might be needed.

Supplementing your DPS Policy

You can’t increase the payout amount under the Dependants’ Protection Scheme. However, you can supplement your coverage with a separate term life or whole life insurance policy, which is worth considering especially if you have liabilities like a car loan or home mortgage.

Term life insurance policies are similar as DPS but you can select the amount of payout you want, and your premiums will be adjusted accordingly.

Whole life insurance polices on the other hand, not only just provide coverage but also accumulate cash value. However, the premium is usually higher than that of a Term Life insurance policy.

Whether a Term Life or Whole Life insurance is more suitable for you, it very much depends on your personal financial plan and needs.

If you need advice on supplementing your DPS, book an appointment with our Financial Planners from FLA Organization for more information today.