If you are a Singapore Citizen or Permanent Resident, it is likely that CPF forms a substantial part of your assets.

This is because all working Singaporeans and PRs are required to make monthly CPF Contributions.

When you first join the workforce, your CPF contributions will amount to 37% of your monthly wages, with 17% contributed by your employer and 20% contributed by yourself.

A large portion of this, 23% of your wages to be specific, goes towards your Ordinary Account (OA), which can also be used for your first home purchase in future.

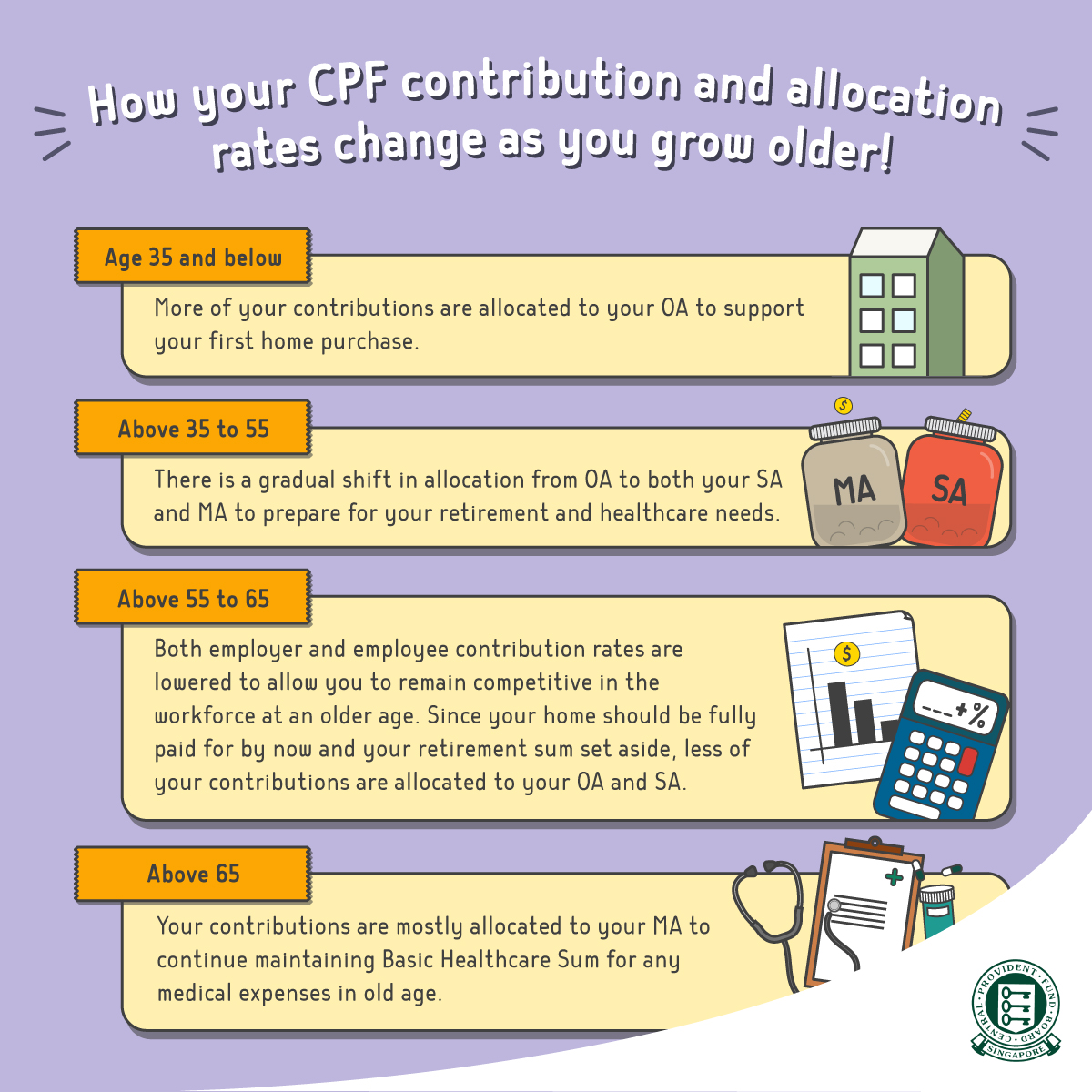

Your CPF contribution and allocation rates will change as you get older, as shown in the infographic below.

Source: CPF.gov.sg

As Singaporeans are living longer and cost of living is increasing, there is a increased possibility of Singaporeans out-living their savings.

To solve this problem, the Singapore Government introduced CPF LIFE – a life annuity that provides you with a monthly payout from age 65 (the current payout eligibility age) for as long as you live.

On your 55th birthday, a Retirement Account (RA) will be created for you and savings from your Special Account (SA) and Ordinary Account (OA) will be transferred to your RA to form your retirement sum.

Your retirement sum will be used to buy CPF LIFE that provides you with lifelong monthly payouts from your payout eligibility age which is currently at age 65.

The exact amount of retirement sum that will be deducted as annuity premium will depend on the plan type you have chosen, and will be made known to you when your CPF LIFE Plan is issued.

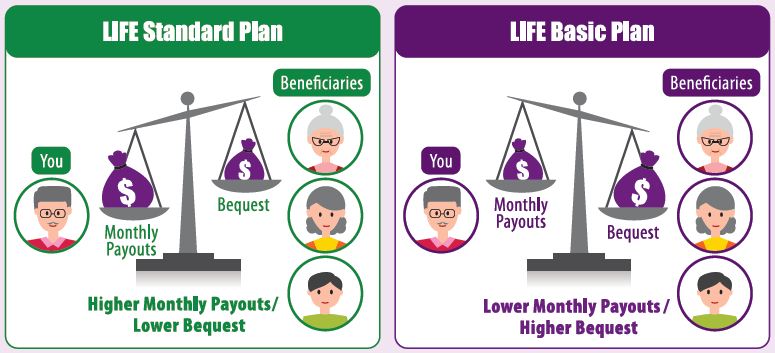

There are 2 types of plans.

- The standard plan gives a higher monthly payout but lower bequest.

- The basic plan gives a lower monthly payout but higher bequest.

Source: CPF.gov.sg

How do you incorporate CPF LIFE into your Retirement Planning?

If you are born in 1981 or earlier, you will can use the CPF LIFE Estimator to estimate how much you need in your Retirement Account in order to receive your desired CPF LIFE monthly payouts.

You can also use the tool to estimate the monthly payouts under CPF LIFE.

https://www.cpf.gov.sg/eSvc/Web/Schemes/LifeEstimator/LifeEstimator

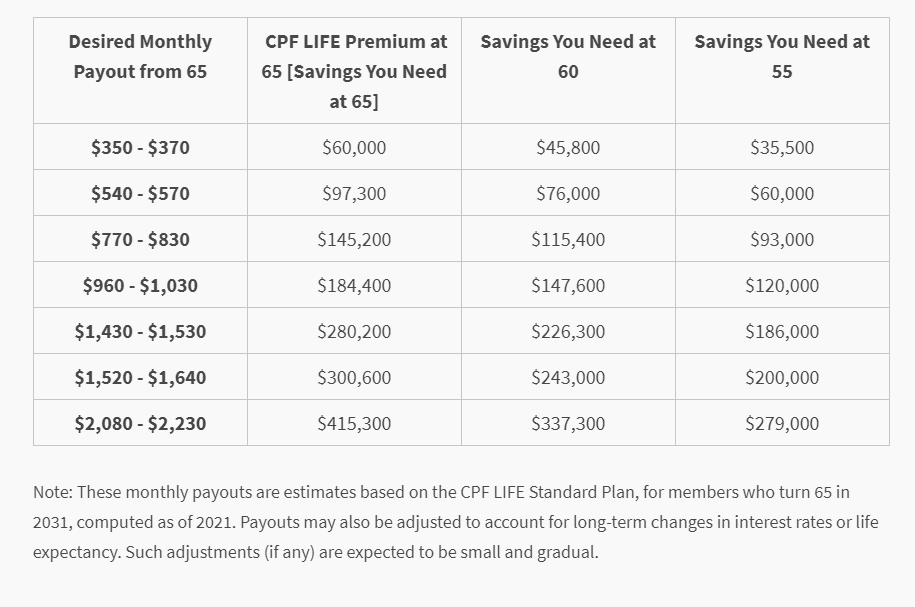

Please keep in mind that all the figures provided are estimates.

Source: CPF.gov.sg

According to the table above, if you want to have a monthly payout of $2,080 to $2,230, you need about $415,000 in your Retirement Account at age 65.

Alternatively, a much lesser sum of $279,000 is required if you set aside the amount in your RA at 55. This is because CPF interest rates of up to 6% will help you grow your savings through compound interest.

This example above illustrates the importance of saving up your retirement funds as early as possible, and then let the power of compounding work for you.

Is CPF LIFE enough for retirement?

We shall discuss this in greater depth in our next article.

If you’d like to learn more about Retirement Planning, contact your trusted FLA Organization financial planner today!