In part 1 of our article, we explained what is CPF Life. It is a life annuity that provides you with a monthly payout from age 65 (the current payout eligibility age) for as long as you live.

Source: CPF.gov.sg

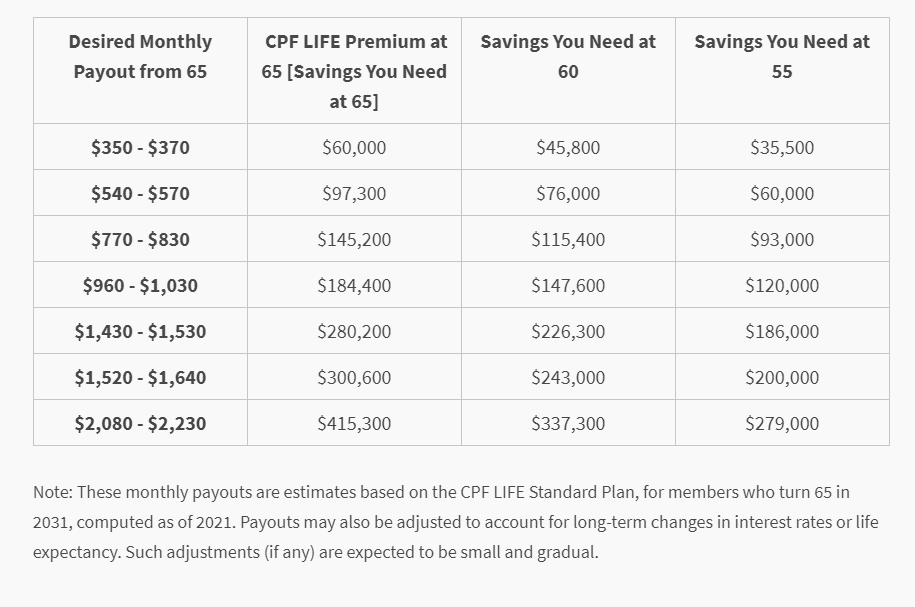

According to the table above, if you want to receive a monthly payout of $2,080 to $2,230 from CPF LIFE, you need to set aside about $415,000 in your Retirement Account (RA) at age 65.

Alternatively, a much lesser sum of $279,000 is required, if you set aside the same amount in your RA at age 55. This is because CPF interest rates of up to 6% will help you grow your savings through compound interest.

CPF LIFE should be incorporated in your retirement planning, since all working Singapore Citizens and PRs must contribute up to 20% of their monthly income to CPF. In addition, employers also need to contribute up to 17% of their employees’ monthly income to CPF. This adds up to 37% which is quite significant.

Furthermore, CPF is a relatively low-risk investment with moderate returns (2.5-6% per year). This characteristic makes it suitable for retirement planning, because most people tend to have lower risk tolerance as they get older.

Source: CPF.gov.sg

However, one major downside is the long lock-up period. You may not be able to withdraw your money, until you reach the retirement age (currently age 55). On top of that, there are also opportunity costs as you could have invested your money into stocks, mutual funds, property, etc which may give you higher potential returns.

Taking the above factors into consideration, you probably want to calculate how much you need in your CPF Retirement Account to receive your desired CPF LIFE monthly payout.

But the saying goes “Don’t put all your eggs in one basket”. Some of your money can also be allocated to stocks, mutual funds, property for higher potential returns.

Ideally you want your retirement portfolio to be well diversified, and CPF LIFE can form part of it.

If you’d like to learn more about investment and portfolio management, contact your trusted FLA Organization financial planner for more information today!