Many people think CPF (Central Provident Fund) and SRS (Retirement Scheme) are the same thing. They are not.

There are a number of key differences between CPF and SRS:

Multiple Objectives vs Single Objective

CPF can be used for multiple purposes like insurance, healthcare, housing, and investments.

Source: CPF

The CPF comprises of the Ordinary Account (OA), Medisave Account (MA), and Special Account (SA).

The Ordinary Account can be used to pay for:

- Properties including HDB, residential, commercial, and industrial properties.

- Term Insurance (Dependents’ Protection Scheme) and Mortgage-Reducing Term insurance (Home Protection Scheme). In the event of death or total and permanent disability occurring to the policy owner, his family will receive some monies to relief the financial hardship.

- Tertiary Education of the member or his children can also be paid for using CPF-OA. The children will have to repay the funds, including interest, after their graduation.

The Medisave Account can be used to pay for:

- Relevant medical expenses incurred by the policy owner, as well as his family member.

- Medishield and integrated shield plan premium.

The Special Account can be used for investments which approved under the CPF Investment Scheme.

Furthermore, CPF also functions as a long-term compulsory savings scheme.

In contrast, SRS has only one sole objective:

To provide certain tax incentives to encourage people to make contributions and investment in an SRS account, which can help the contributor save up for retirement.

Compulsory vs Voluntary

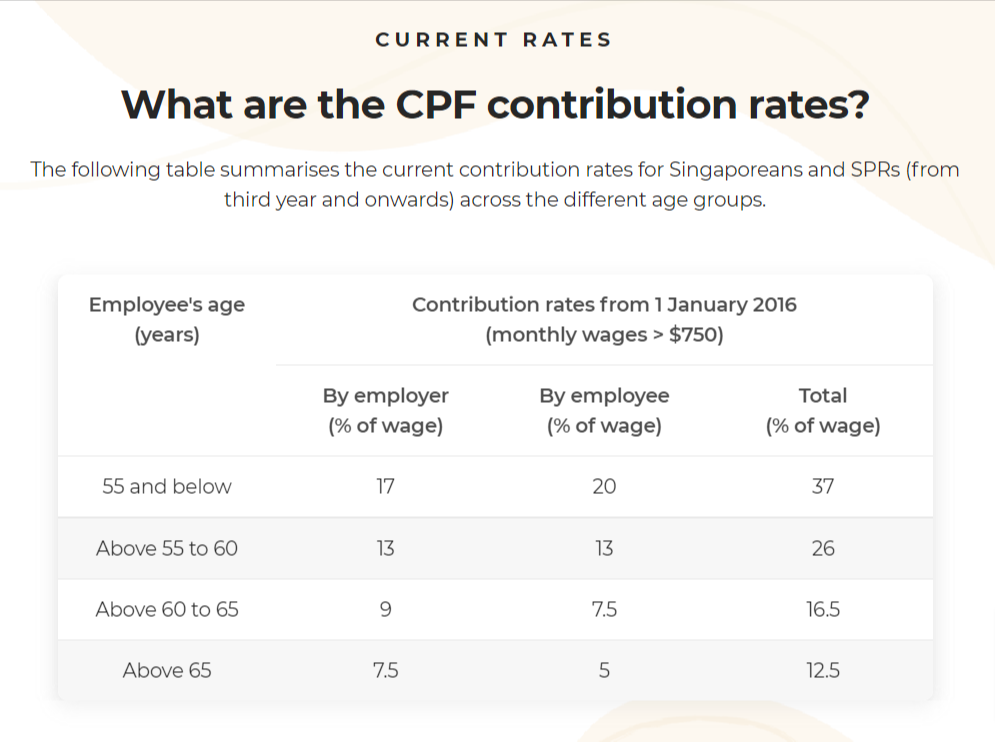

Source: CPF

CPF Scheme is compulsory for all working Singaporeans and Permanent Residents. Employees must follow the fixed contribution rates, based on the member’s respective age band.

However, participation in the SRS is voluntary. The member can decide how much to contribute (with a maximum yearly contribution of S$15,300 for Singaporeans and Singapore PRs, and S$35,700 for foreigners) or not contribute at all.

Government vs Private Operators

CPF savings are managed by the CPF Board, by the CPF board and payment of the savings at the stipulated time is underwritten by the government as provided for in the CPF Act. In comparison, the SRS funds are held by SRS Operators (DBS, OCBC, UOB) and the payment is not guaranteed by the government.

Difference in Tax Positions

All CPF funds whether maintained in the CPF account or upon withdrawal are not subject to income tax. The member’s contributions are deductible as tax relief .

Ease of Withdrawal

Under the CPF scheme, members cannot make withdrawals unless expressly permitted by the CPF rules. For example, under certain circumstances, CPF can be withdrawn to pay for housing, insurance, education, medical or investment needs.

In contrast, SRS funds can be withdrawn at any time, but will be subject to tax and also a penalty if withdrawn prematurely.

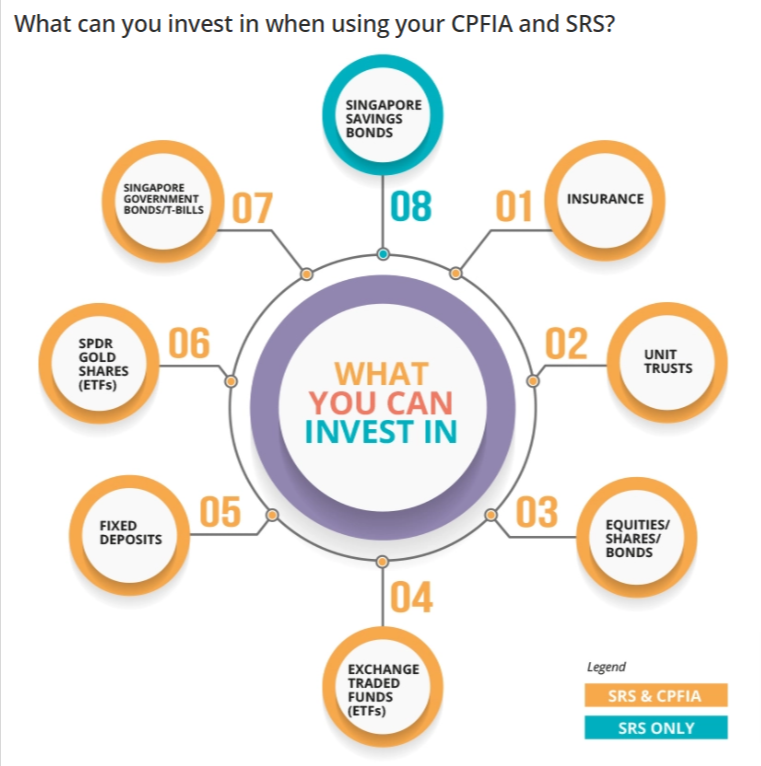

Range of Investment Products Available

Both schemes have a different range of investment products that the funds can purchase.

Source: DBS

If you found this article useful, please share it with your friends.

If you need financial planning services, book an appointment with our Financial Planners from FLA Organization for more information today.