The Straits Times carried an article with the headline “MediShield Life premium hike: Delay now, larger rise later“.

The article is related to the recent news that MediShield Life premiums may rise by up to 35% for some, proposed as part of review. The proposed increase will pay for a wider range of benefits, as well as rising healthcare costs. These benefits include raising the yearly claim limit from $100,000 to $150,000.

The proposed premium increase has sparked a strong reaction from the public. According to the article, many who wrote to The Straits Times Forum section called on the Government to do more to check rising healthcare costs, which they saw as the root of the problem.

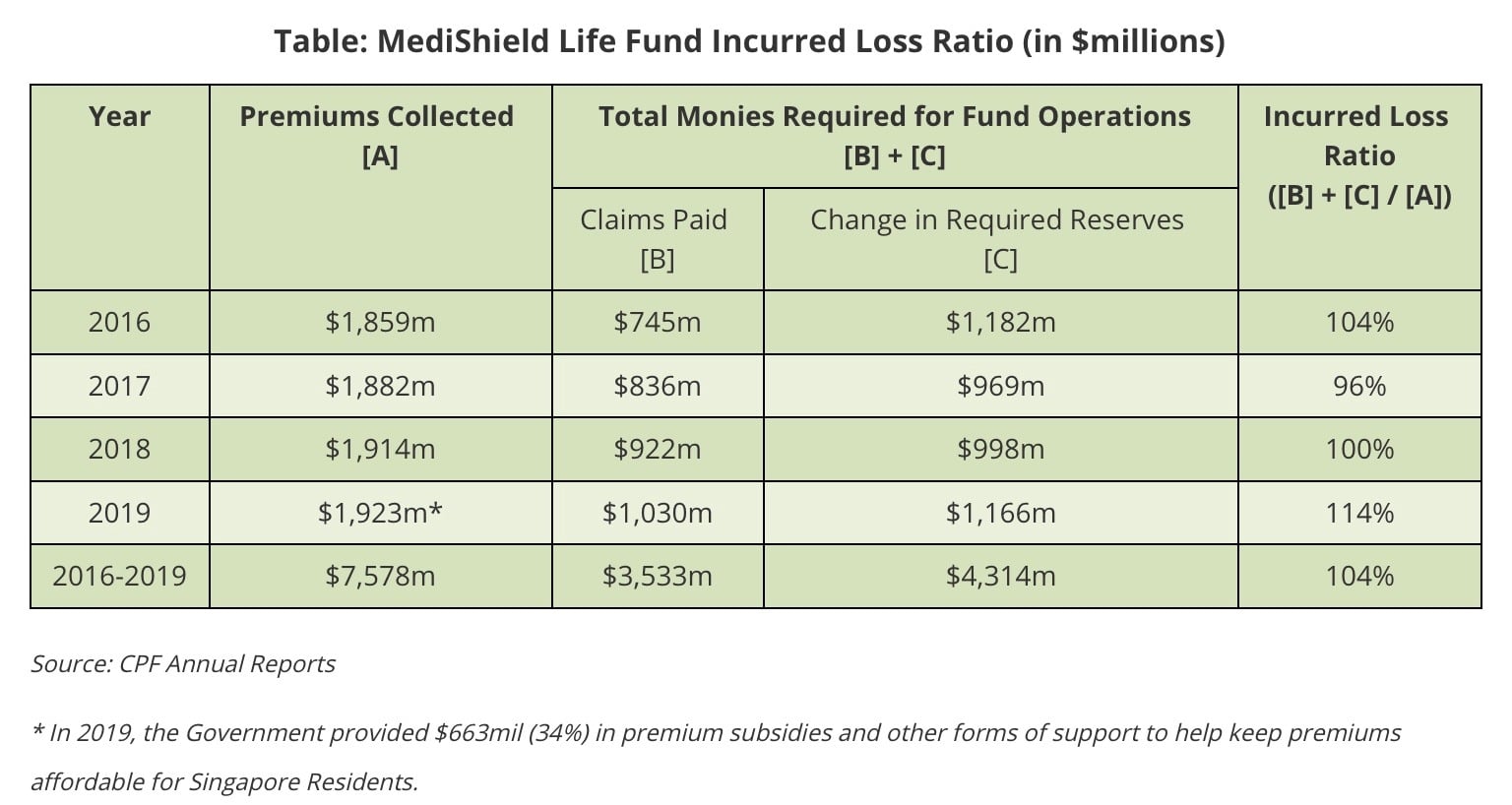

One reader pointed out that premiums collected under the scheme between 2016 and last year were more than double what was paid out in claims.

Dr Koh responded that premiums for the compulsory national health insurance scheme are determined by actuaries and based on both current claims and future commitments. This is why total premiums collected are higher than current payouts. He also mentioned that delaying the increase in MediShield Life premiums will only result in steeper hikes down the road to catch up with rising claims.

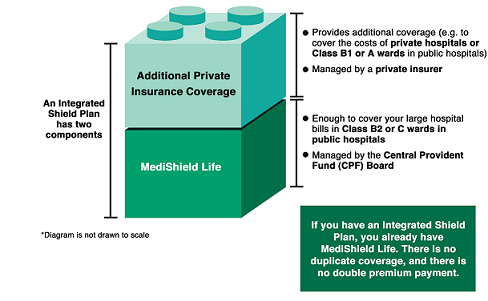

While no one can predict the future, it is likely that the premium increase will have an impact on on private Integrated Shield Plans, which build upon what MediShield Life has to offer.

Source: MOH

As medical expenses in Singapore continue to rise, it wouldn’t be surprising to expect more premium hikes in the future. Therefore it is important for us to manage our finances wisely – ideally we want to invest in assets that can provide returns greater than inflation. If you would like to find out more about financial planning, contact your trusted FLA Organization financial planner for more information today.

Source: Straits Times, CPF Annual Reports, Ministry of Health