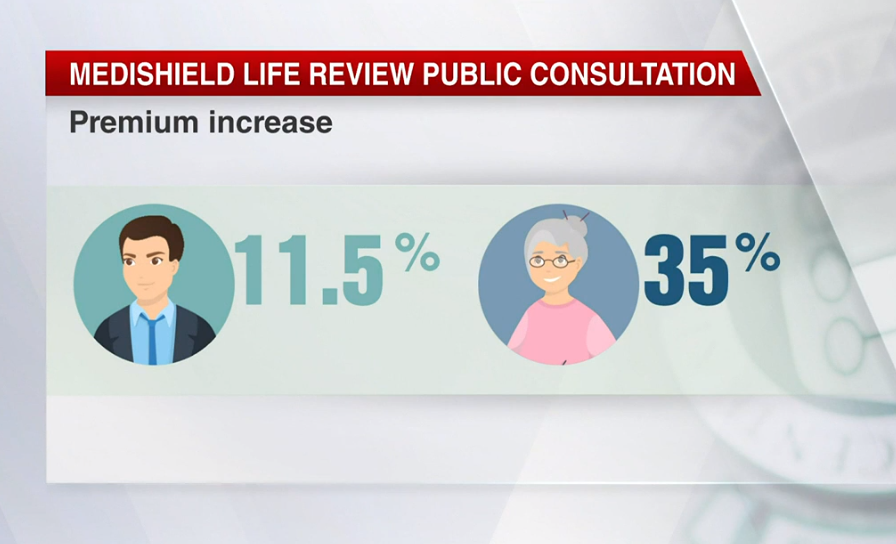

As reported on CNA, premiums for MediShield Life may increase by up to 35% in the next few years (before subsidies) as the MediShield Life Council seeks to improve benefits of Singapore’s national health insurance scheme.

Source: CNA

MediShield Life premiums are expected to go up by more than 10% across the board, while those age 61 and above will see the biggest increase of about 35%.

Source: CNA

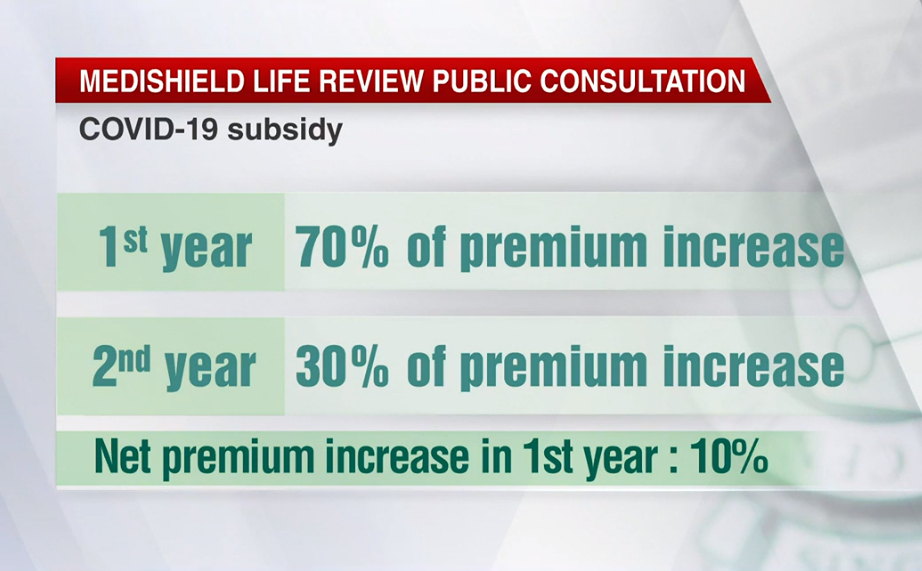

To soften the impact of the premium increase, the government will provide a one-time COVID-19 subsidy, which will cover 70% of the premium increase in the first year, 30% of the premium increase in the second year. This translates to about 10% net premium increase in the first year.

There will also for additional support for lower income residents and seniors over the next 3 years. To minimize cash payment, MediShield Life premiums will continue to be fully payable via MediSave.

What are the proposed changes?

Source: CNA

The preliminary recommendations for MediShield Life include:

- Higher annual claim limits for daily ward and treatment expenses

- Lowering the deductible for day surgery patients above 80 years old

- Removal of standard exclusions for treatments

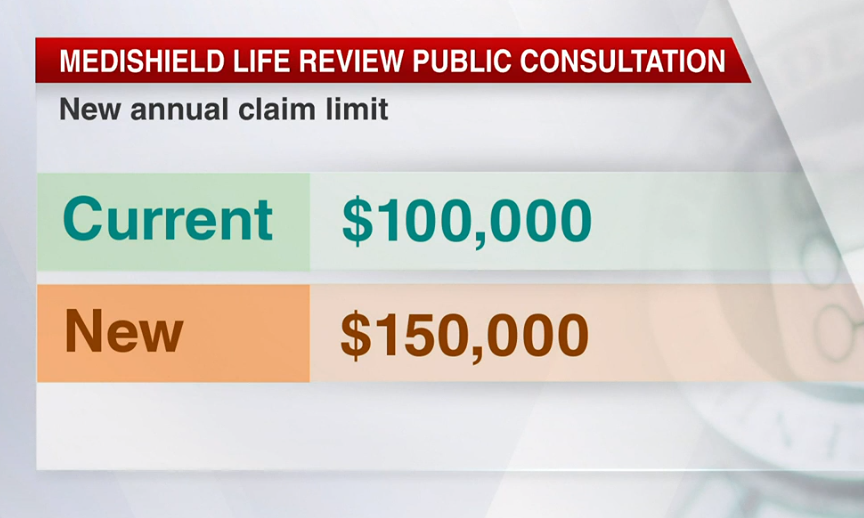

The MediShield Life Council recommended raising the policy year claim limit from S$100,000 to S$150,000.

Another recommendation by the council is raising the treatment-specific claim limits for community hospital care and outpatient radiotherapy.

Patients with short hospital stays could receive more support, as the council proposed increasing claim limits for daily ward and treatment charges for the first two days of acute hospital stays.

To encourage older patients to undergo day surgery, the council proposed lowering the deductible for day surgery patients above 80 years old from S$3,000 to S$2,000. This will match the amount payable for inpatient stays in C class wards.

Another suggestion includes lowering the pro-ration factor for private hospitals from 35% to 25%, to better reflect the actual bill differences and ensure more similar payouts between private hospital and subsidized patients

A public consultation on the recommendations will be held from Tuesday until 6pm on Oct 20.

Authorities expect to implement the changes in early 2021.

How does this affect Integrated Shield Plans (IPs) offered by private insurers?

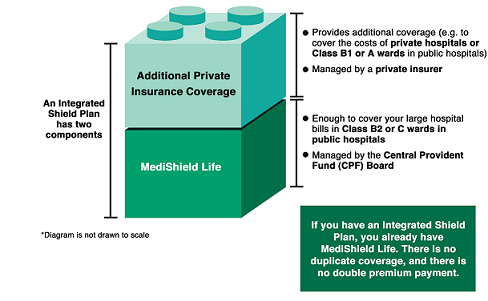

A MediSave-approved private Integrated Shield Plans (IP), is an insurance plan that comprises:

- MediShield Life

- Private insurance coverage providing additional benefits and coverage (e.g. to cover the costs of private hospitals or A/B1-type wards in the public hospitals).

Source: MOH

If you have an IP, you are already covered by MediShield Life. The premiums you pay to your private insurer already include the premiums for the MediShield Life component.

If the proposal by the MediShield Life Council is implemented, it is likely that the premiums of IPs will be adjusted.

If you have any questions about health insurance or would like to review your health insurance, do contact your trusted FLA Organization Financial Planner for more information today!