What exactly is SRS?

The Supplementary Retirement Scheme (SRS) was introduced by the Singapore government in 2001 to help Singaporeans save more for their old age.

If you are contributing to SRS. you’re probably know it’s a great tool for tax deferment and tax reduction.

However are you aware that your SRS contributions can also be used to grow your retirement funds by investing in SRS-approved financial instruments like local stocks, bonds and unit trusts?

If you aren’t using your SRS funds for investment, you are actually losing a lot of potential gains. Continue reading to see what why.

SRS Un-invested

The SRS deposit rate is 0.05% per annum. If you leave your SRS funds un-invested, 0.05% per annum is the interest rate you’ll get.

Stocks

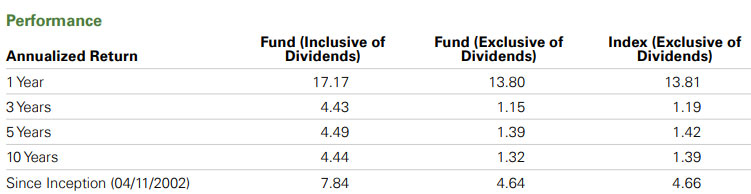

Next we look at Singapore stocks. As there are hundreds of Singapore stocks, the easiest way to gauge the overall Singapore stock market performance is to look at the Straits Times Index which consists of the top 30 companies listed on the Singapore Stock Exchange.

According to States Street Global Advisors, their SPDR STI ETF, an exchange traded fund which closely mirrors the performance of the STI, has an annualized return of 7.84% (as of 08 June 2018).

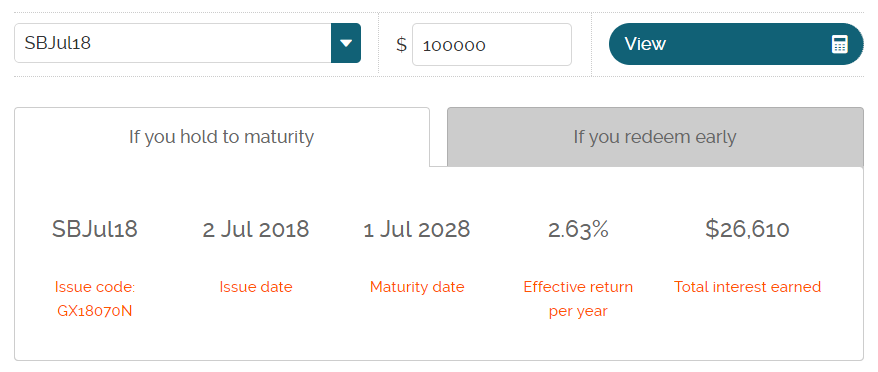

Bonds

Next we look at Singapore Bonds. We will use Singapore Savings Bonds as our benchmark for Singapore Bonds because it is a bond issued by Singapore Government. According to the interest calculator on their website, their Effective Return Per Year is 2.63%.

Unit Trusts

Next we look at Unit Trusts. The return rate for unit trusts depends on the underlying fund performance. As you can see below, it is possible to achieve a return of 10% or more per annum, but to be conservative, we will assume an annual return of 8%.

MorningStar Asian Funds Performance (As of 11 June 2018)

SRS Investment Returns Comparison – Un-invested vs Stocks vs Bonds vs Unit Trust

Assuming you invested $100,000 in each financial-instrument over a period of 10 years, these are the potential returns you’ll get at the end of the investment period.

| SRS Invested In | Original Capital | Annual Return | Amount After 10 Years | Amount After 20 Years |

|---|---|---|---|---|

| Un-invested | $100,000 | 0.05% | $100,511 | $101,005 |

| Stocks | $100,000 | 7.84% | $212,715 | $452,478 |

| Bonds | $100,000 | 2.63% | $146,933 | $168,069 |

| Unit Trust | $100,000 | 8.00% | $215,893 | $466,096 |

The above annual return are only estimates, but one thing is certain… leaving your SRS un-invested at 0.05% is without a doubt a poor financial choice for anyone, because its return is simply too low compared to the other 3 investment options.

If you haven’t invested your SRS funds yet, you need to start considering today because you might be losing out on potential gains, and you may take a much longer time to save enough for your retirement.