You may be surprised that most Singapore Citizen and Permanent Residents don’t know the answer even though they contribute to CPF every month.

One reason is because CPF Board changes their rules from time-to-time. Unless you monitor the CPF website every day, it hard to keep track of the latest changes.

The second reason is because there are many different CPF components (Ordinary Account, Special Account, Medisave Account, Retirement Account). Each component is governed by different rules, making it difficult to remember all of them.

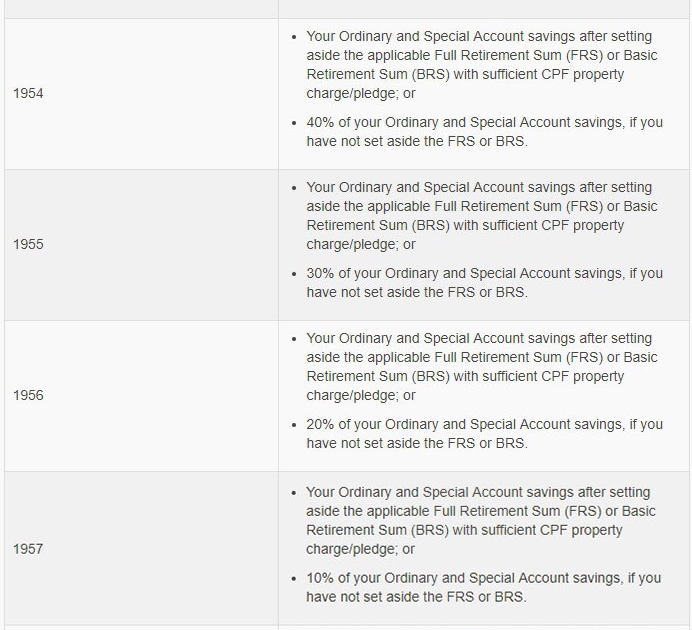

Last but not the least, different rules apply to different age groups. For example if you are born before 1954, you are allowed to withdraw 50% of your Ordinary and Special Account savings, even if you have not set aside the Full Retirement Sum or Basic Retirement Sum at age 55. However if you are born after 1957, you are only allowed to withdraw up to $5,000 if you are in the same situation.

If you found the above confusing, please don’t worry.

In this article, we shall explain the CPF withdrawal rules in a simple-to-understand way.

Understanding the 4 CPF Components

There are 4 components in CPF

- Ordinary Account (OA)

- Special Account (SA)

- Medisave Account (MA)

- Retirement Account (RA)

OA is commonly used for housing (eg. Housing Loan Repayments).

SA is commonly used for investment (eg. CPF Investment Scheme)

MA is commonly used for medical expenses (eg. Hospitalization Expenses)

RA is automatically created when you reach age 55. At age 55, savings from your OA and SA, will be transferred to your RA to form your Retirement Sum (see illustration below).

Source: cpf.gov.sg

You can decide which Retirement Sum you want to contribute to your RA:

- (BRS) Basic Retirement Sum – If you own property with sufficient CPF property charge/pledge or,

- (FRS) Full Retirement Sum is 2 x BRS – If you do not own property or wish to have higher payouts or,

- (ERS) Enhanced Retirement Sum is 3 x BRS – If you wish to have even higher payouts

If you contribute a higher Retirement Sum, you will receive higher CPF LIFE monthly payouts between age 65 and 70.

If you contribute Basic Retirement Sum, you will receive a lower payout.

How much must I contribute for BRS, FRS, or ERS?

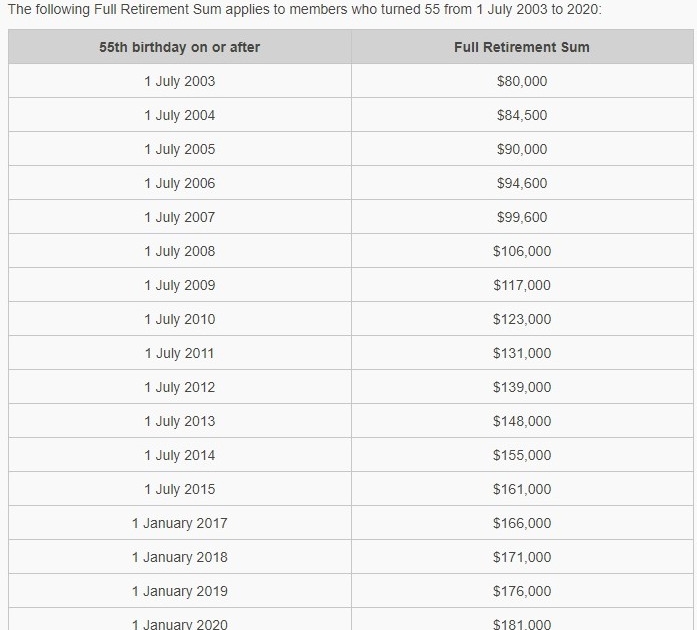

The amount you need to contribute depends on your birthday (refer to table below).

FRS Table

Source: cpf.gov.sg

From the table above, you can easily calculate the BRS (FRS ÷ 2) and ERS (BRS x 3) based on the respective FRS amount.

For example, if my 55th birthday falls on 1 July 2014, my FRS will be $155,000, my BRS will be $155,000 ÷ 2 = $77,500 and my ERS will be $77,500 x 3 = $232,500.

How much money can you withdraw from CPF?

Source: cpf.gov.sg

If you born after 1957, the amount you can withdraw from CPF is your Ordinary and Special Account savings after setting aside the applicable Full Retirement Sum (FRS) or Basic Retirement Sum (BRS) with sufficient CPF property charge/pledge.

In other words, the Amount You Can Withdraw from CPF at Age 55 = OA + SA – (BRS or FRS or ERS depending on which Retirement Sum you want to contribute to your RA)

We hope you’ve gotten some useful information from this article. If you like this article, please share it on facebook, so that others can enjoy it too.