Every Singapore Citizen and Singapore Permanent Resident will have a CPF Account. Since CPF Scheme is compulsory, it’s best that you plan your CPF funds wisely to maximize your gains.

CPF Scheme has 4 components:

- Ordinary Account (OA)

- Special Account (SA)

- Medisave Account (MA)

- Retirement Account (RA)

Each component has different functions:

- OA can be used for investment, insurance, education, and housing

- SA is used for investment

- MA is used for healthcare

- RA is used for retirement and will be automatically created on your 55th birthday. Savings from your OA and SA will be transferred to your RA to form your retirement sum, which will provide you with monthly payouts.

While there is very limited action you can take for MA and RA, you can manage your funds in CPF-OA or CPF-SA for the better returns.

CPF interest rates are reviewed every quarter. As of 23 October 2018, Central Provident Fund (CPF) members currently earn interest rates of up to 3.5% per annum on their Ordinary Account (OA) monies, and up to 5% per annum on their Special Account (SA) monies. These interest rates include an extra 1% interest paid on the first $60,000 of a member’s combined balances (with up to $20,000 from the OA).

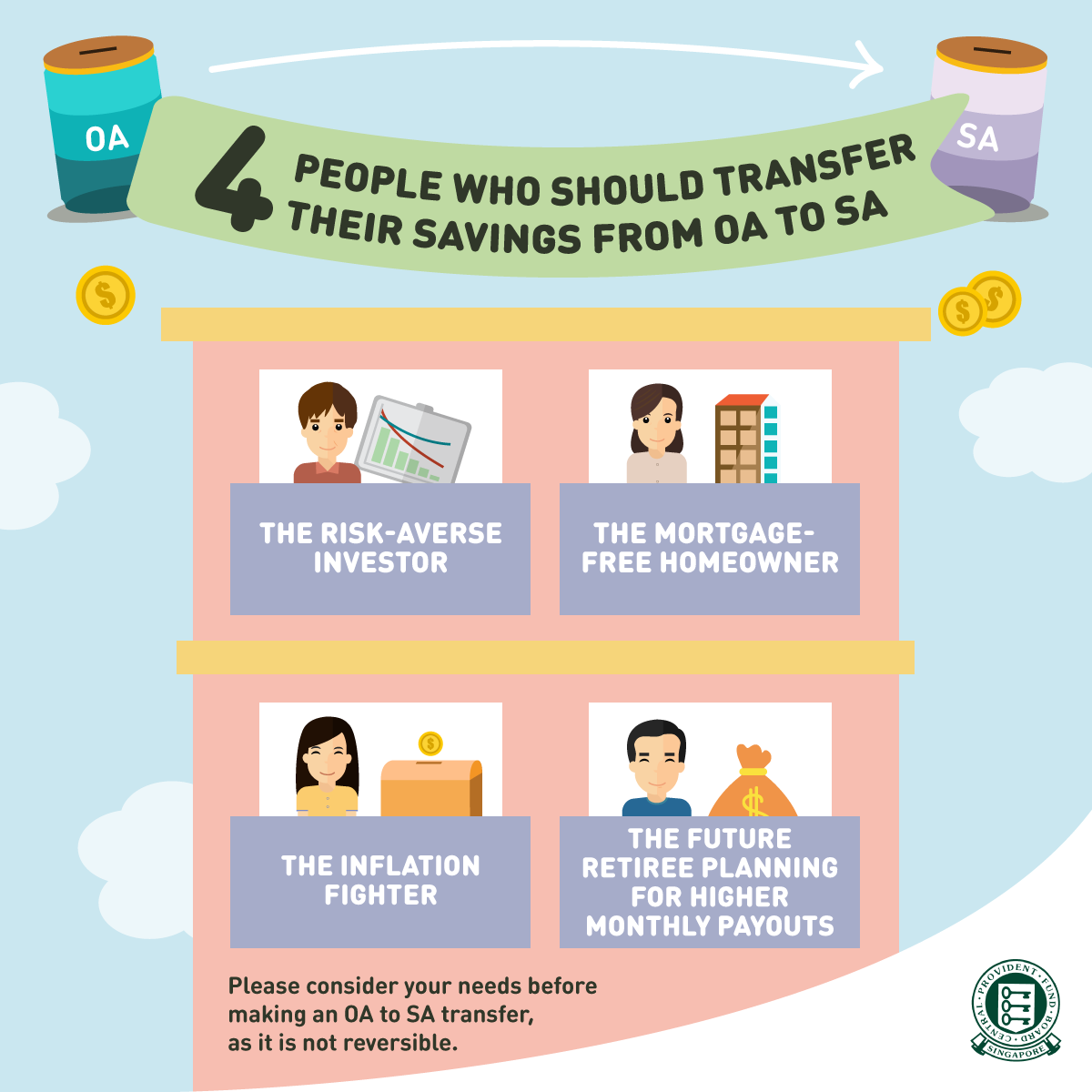

You can do a transfer from your OA to your SA to enjoy higher interest. However, not everyone should do this. According beready.sg there are 4 types of people who should consider it:

Source: beready.sg

1. The Risk-Averse Investor

If you’re afraid of shady investment schemes, you can grow your money risk-free in your SA — which earns up to 5% p.a. interest, compared to your OA savings that earn up to 3.5% p.a. These rates include an extra 1% on the first $60,000 of your combined CPF balances (with up to $20,000 from the OA). By making a CPF transfer, you can grow your savings faster with the higher compound interest rate.

2. The Mortgage-Free Homeowner

One benefit of your OA savings is its ability to be used for financing your housing loan. However, if your loan is fully paid, you no longer need to reserve your OA savings for housing! This gives you the freedom to transfer part of your OA savings to your SA to earn more interest for retirement.

If you have other payments that use your OA savings, such as a CPF Education Loan or your DPS premiums, you can also make the transfer to your SA after setting aside sufficient savings.

3. The Inflation Fighter

You could benefit from a CPF transfer too! Your SA savings earn risk-free interest at a floor rate of 4%, which is currently higher than the headline inflation rate in Singapore.

4. The Future Retiree Planning for Higher Monthly Payouts

Compound interest will more than double your SA savings in 20 years. By leveraging on the higher interest rate in your SA (up to 5% p.a.) over time, you will be able to increase the size of your CPF LIFE payouts in the future.

Do note that a transfer of savings from OA to SA cannot be reversed, and you should consider your needs carefully before doing so. Transfers can be made up to the current Full Retirement Sum in your SA (for those below 55) and up to the current Enhanced Retirement Sum in your RA (for those 55 and above). For more information, please visit the CPF website, or check with your Financial Planner before making a decision.