If you’re a Singaporean or Singapore Permanent Resident, then Central Provident Fund (CPF) is important because you’re contributing up to 20% of your monthly income.

However, not everyone likes the CPF Scheme.

Let’s look at some hard facts of CPF and share with you some of our opinions.

What does CPF consist of?

CPF consist of 4 components. Each component serves different needs.

| Component | Interest/Year | Primary Usage |

|---|---|---|

| Ordinary Account (OA) | 2.5% | |

| Special Account (SA) | 4% | |

| Medisave (MA) | 4% | |

| Retirement Account (RA) | 4% | |

| There will be an extra 1% interest paid on the first $60,000 of your combined CPF balances, with up to $20,000 from the OA. | ||

The 3 Major Advantages of CPF

There are 3 major advantages of CPF:

- Disciplined savings

- Higher interest rate than Fixed Deposits

- Stable returns

The main advantage of disciplined savings.

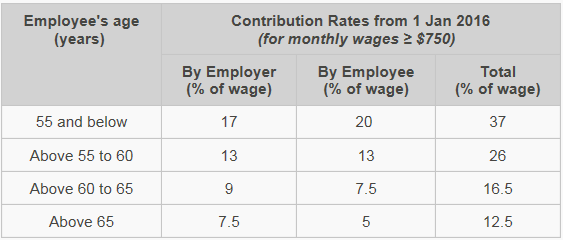

Source: CPF.gov.sg

If you are a Singapore Citizen aged 55 and below; and working in Singapore, it is compulsory to contribute up to 20% of your monthly income to CPF. In addition, your employer will also need to contribute another 17%. This adds up to 37% of your monthly income contributed to CPF, which makes up a significant amount. It’s great in a way, because it forces you to save.

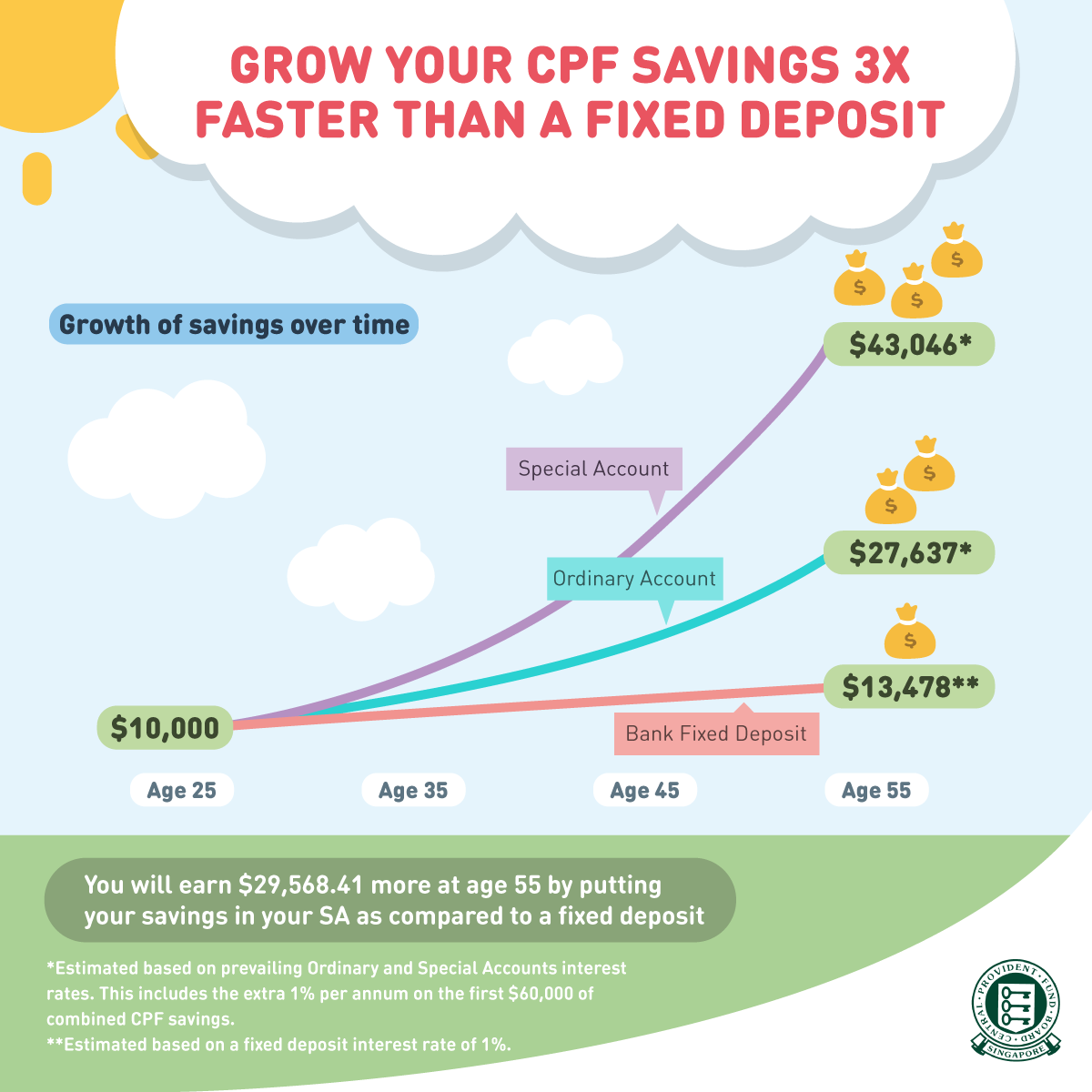

Another advantage of CPF is that it offers a higher return than fixed deposits. A 24 month fixed deposit typically offers a return of 1.5% to 1.6% per annum (excluding promotions) whereas CPF-OA offers a stable return of 2.5% per annum.

On top of that, an extra 1% interest paid on the first $60,000 of your combined CPF balances, with up to $20,000 from the OA. This means you’ll receive up to 3.5% per annum from OA and up to 5% per annum from SA.

Source: gov.sg

Furthermore, as a national social security savings scheme, CPF offers one of the most stable returns in the Singapore market. This combination of reasonable returns and high stability makes it an attractive savings scheme.

Source: areyouready.sg

The 2 Major Disadvantages of CPF

In the first part of this article, we covered the advantages. Now we shall look at the more controversial disadvantages.

The 2 biggest complains about CPF are:

- It’s very difficult to withdraw your money

- There is a long lock-in period

For example you can only withdraw from CPF if you:

- Reach age 55

- Meet meet the Full Retirement Sum (FRS) or Basic Retirement Sum (BRS) with sufficient CPF property charge/pledge. You can read more about CPF withdrawals from the official website.

On the flip side of disciplined savings, there is also no option to opt-out of the CPF scheme (unless you renounce your Singapore Citizenship) which leads to much dissatisfaction among Singapore netizens.

For example: If you know of better investment opportunities elsewhere that could allow you to make a higher return than CPF, wouldn’t it make sense to park your money there instead (assuming that is within your risk tolerance)?

So what should you do about CPF?

It’s perfectly understandable that nobody wants their hard-earned money to be controlled by others.

Assuming you remain a Singapore Citizen or Singapore PR, you should probably make CPF part of your retirement plan.

Here’s some steps that might be helpful for your retirement planning

- Decide what age you want to retire

- Calculate how much monthly income you need when you retire

- Estimate much CPF you will accumulate when you reach your retirement age based on your current monthly income

- Calculate any shortfall (after factoring in your CPF contributions)

- Plan how to cover your shortfall through the use of endowment and investment plans

If your mind is boggling right now, don’t worry because you don’t have to do all the steps by yourself.

An experienced Financial Planner can help you work out the calculations and recommend the suitable plans to help you achieve your financial and retirement goals. Think of it like having a partner watch your back while you carry on with the important things in life (eg. getting married, buying home, starting a family, prepare for children’s education, etc).

To sum it up, CPF is here to stay. As the old saying goes, if you can’t beat ‘em, join ‘em. Make CPF part of your retirement plan, and seek help from a Financial Planner if you need to.

If you like this article, please share it on Facebook so others can enjoy it too.